Anthem Blue Cross 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

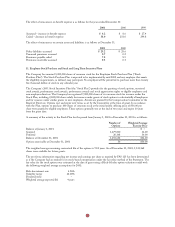

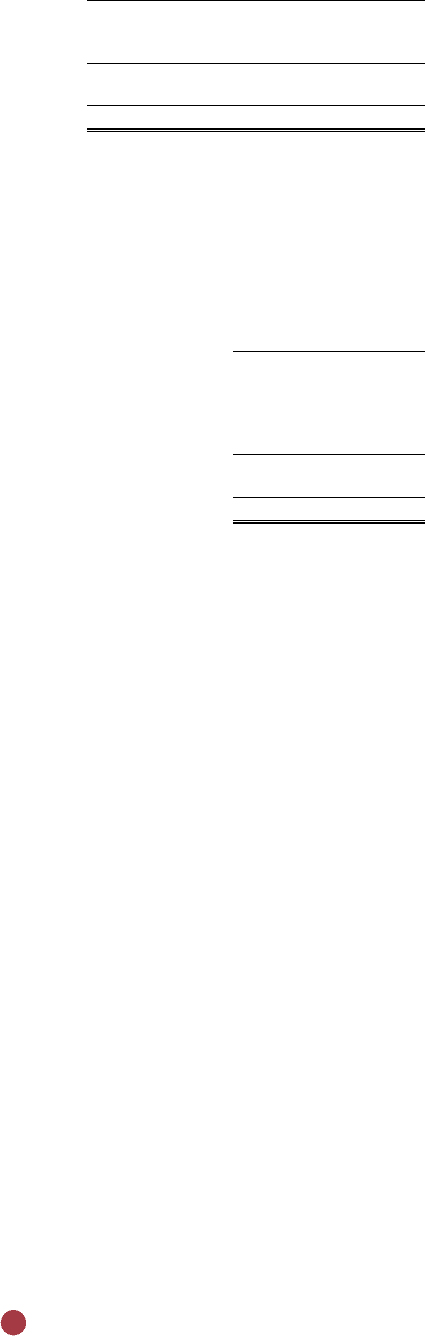

The major categories of net investment income are as follows:

2001 2000 1999

Fixed maturity securities $220.5 $178.8 $137.0

Equity securities 6.4 6.1 6.3

Cash, cash equivalents and other 15.7 21.5 12.8

Investment revenue 242.6 206.4 156.1

Investment expense (4.0) (4.8) (4.1)

Net investment income $238.6 $201.6 $152.0

Proceeds from sales of fixed maturity and equity securities during 2001, 2000 and 1999 were $3,488.8, $2,911.8 and

$2,336.8, respectively. Gross gains of $164.3, $71.3 and $86.8 and gross losses of $103.5, $45.4 and $49.3 were

realized in 2001, 2000 and 1999, respectively, on those sales.

6. Long Term Debt and Commitments

Debt consists of the following at December 31:

2001 2000

Surplus notes at 9.125% due 2010 $295.9 $295.5

Surplus notes at 9.00% due 2027 197.3 197.2

Senior guaranteed notes at 6.75% due 2003 99.7 99.5

Debentures included in Units at 5.95% due 2006 220.2 –

Other 5.2 5.5

Long term debt 818.3 597.7

Current portion of long term debt (0.3) (0.2)

Long term debt, less current portion $818.0 $597.5

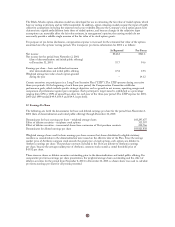

Surplus notes are unsecured obligations of Anthem Insurance and are subordinate in right of payment to all of

Anthem Insurance’s existing and future indebtedness. Any payment of interest or principal on the surplus notes may

be made only with the prior approval of the Indiana Department of Insurance (“DOI”), and only out of capital and

surplus funds of Anthem Insurance that the DOI determines to be available for the payment under Indiana

insurance laws. For statutory accounting purposes, the surplus notes are considered a part of capital and surplus

of Anthem Insurance.

Senior guaranteed notes are unsecured and unsubordinated obligations of Anthem Insurance and will rank equally in

right of payment with all other existing and future senior indebtedness of Anthem Insurance.

On November 2, 2001, Anthem issued 4,600,000 of 6.00% Equity Security Units (see Note 2). Each Unit contains a

5.95% subordinated debenture. The debentures are unsecured and are subordinated in right of payment to all of

Anthem’s existing and future senior indebtedness. The debentures will mature on November 15, 2006. Each debenture

will initially bear interest at the rate of 5.95% per year, payable quarterly, commencing February 15, 2002, subject to

Anthem’s rights to defer these payments.

On November 5, 2001, Anthem and Anthem Insurance entered into two new unsecured revolving credit facilities

totaling $800.0. Anthem is jointly and severally liable for all borrowings under the facilities. Anthem also will be

permitted to be a borrower under the facilities, if the Indiana Insurance Commissioner approves Anthem Insurance’s

joint liability for Anthem’s obligations under the facilities. Upon execution of these facilities, Anthem Insurance

terminated its prior $300.0 unsecured revolving facility. Borrowings under these facilities will bear interest at rates, as

defined in the agreements, which generally provide for three different interest rate alternatives. One facility, which

provides for borrowings of up to $400.0, expires on November 5, 2006. The second facility, which provides for

borrowings of up to $400.0, expires on November 4, 2002. Certain amounts outstanding under this facility at

November 4, 2002, as defined in the agreement, may be converted into a one-year term loan at the option of Anthem

and Anthem Insurance. Each credit agreement requires Anthem to maintain certain financial ratios and contains

minimal restrictive covenants. Availability under these facilities is reduced by the amount of any commercial paper

outstanding. No amounts were outstanding under the current or prior facilities at December 31, 2001 or 2000 or

during the years then ended.