Anthem Blue Cross 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

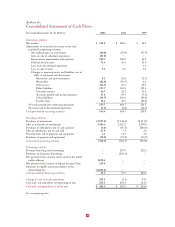

Year Ended December 31, 2001 Compared to Year Ended December 31, 2000

Net cash flow provided by operating activities was $654.6 million for the year ended December 31, 2001,

and $684.5 million for the year ended December 31, 2000, a decrease of $29.9 million, or 4%. In both 2001

and 2000, net cash flow provided by operating activities was impacted by better balance sheet management

resulting from the conversion of certain operating assets, such as receivables and investments in non-

strategic assets, to cash. As the continuing focus on balance sheet management in order to maximize

invested assets began in early 2000, our cash flow provided by operating activities in 2000 is unusually high.

Net cash used in investing activities was $498.1 million for the year ended December 31, 2001, and $761.1

million for the year ended December 31, 2000, a decrease of $263.0 million, or 35%. This decrease was due

primarily to our having directed our investment managers to maintain greater liquidity at December 31,

2001, than at December 31, 2000. In part this liquidity will be necessary to fund the purchase of BCBS-KS,

pending the outcome of the appeal of the Kansas Insurance Commissioner’s decision (see Note 21 to our

audited consolidated financial statements). In 2001 we received cash for the sale of our TRICARE

operations, while in 2000 we used additional cash to purchase BCBS-ME.

Net cash provided by financing activities was $46.6 million for the year ended December 31, 2001, and

$75.5 million for the year ended December 31, 2000, a decrease of $28.9 million, or 38%. Our 2000

financing activities consisted of $295.9 million net proceeds received from the issuance of $300.0 million

of surplus notes on a discounted basis less $220.4 million repayment of bank debt.

On November 2, 2001, Anthem Insurance Companies, Inc., or Anthem Insurance, converted from a mutual

insurance company to a stock insurance company in a process called demutualization. On the date of the

demutualization, all membership interests in Anthem Insurance were extinguished and the eligible statutory

members of Anthem Insurance were entitled to receive consideration in the form of Anthem Inc.’s, or

Anthem’s, common stock or cash, as provided in the demutualization.

The demutualization required an initial public offering of common stock and provided for other capital

raising transactions on the effective date of the demutualization. On November 2, 2001, Anthem completed

an initial public offering of 55.2 million shares of common stock at an initial public offering price of $36.00

per share. The shares issued in the initial public offering are in addition to 48.1 million shares of common

stock which were distributed to eligible statutory members in the demutualization. This number may

ultimately vary when all distribution issues are finalized.

Concurrent with our initial public offering of common stock, we issued 4.6 million 6.00% Equity Security

Units. Each Unit contains a purchase contract under which the holder agrees to purchase, for $50.00, shares

of common stock of Anthem on November 15, 2004, and a 5.95% subordinated debenture. The number of

shares to be purchased will be determined based on the average trading price of Anthem common stock at

the time of settlement. In addition, we will make quarterly contract fee payments on the purchase contracts

at the annual rate of 0.05% of the stated amount of $50.00 per purchase contract, subject to our rights to

defer these payments.

After an underwriting discount and other offering expenses, net proceeds from our common stock offering

were approximately $1,890.4 million (excluding demutualization expenses of $27.6 million). After

underwriting discount and expenses, net proceeds from our Units offering were approximately $219.8

million. In December 2001, proceeds from our common stock and Units offerings in the amount of

$2,063.6 million were used to fund payments to eligible statutory members of Anthem Insurance who

received cash instead of common stock in our demutualization.

36