Anthem Blue Cross 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

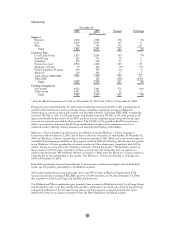

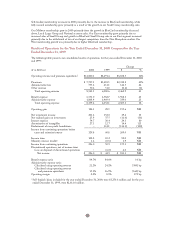

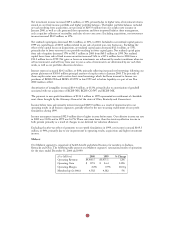

Membership

December 31

2001 2000 Change % Change

(In Thousands)

Segment

Midwest 4,854 4,582 272 6%

East 2,260 2,093 167 8

West 769 595 174 29

Total 7,883 7,270 613 8%

Customer Type

Local Large Group 2,827 2,634 193 7%

Small Group 813 775 38 5

Individual 701 650 51 8

National accounts12,903 2,468 435 18

Medicare + Choice 97 106 (9) (8)

Federal Employee Program 423 407 16 4

Medicaid 119 102 17 17

Total without TRICARE 7,883 7,142 741 10

TRICARE – 128 (128) (100)

Total 7,883 7,270 613 8%

Funding Arrangement

Self-funded 4,052 3,481 571 16%

Fully insured 3,831 3,789 42 1

Total 7,883 7,270 613 8%

1Includes BlueCard members of 1,626 as of December 31, 2001, and 1,320 as of December 31, 2000.

During the year ended December 31, 2001, total membership increased 613,000, or 8%, primarily due to

growth in National business and Local Large Group, including a significant increase in BlueCard

membership as a result of strong sales activity and favorable retention. Excluding TRICARE, membership

increased 741,000, or 10%. Local Large Group membership increased 193,000, or 7%, with growth in all

regions attributable to the success of our PPO products, as more employer groups desire the broad, open

access to our networks provided by these products. The 38,000, or 5%, growth in Small Group business

reflects our initiatives to increase Small Group membership through revised commission structures,

enhanced product offerings, brand promotion and enhanced relationships with brokers.

Medicare + Choice membership decreased as we withdrew from the Medicare + Choice program in

Connecticut effective January 1, 2001, due to losses in this line of business in that market. At December 31,

2000, our Medicare + Choice membership in Connecticut totaled 18,000. With such small membership, we

concluded that attaining profitability in this program would be difficult. Offsetting this decrease was growth

in our Medicare + Choice membership in certain counties in Ohio, where many competitors have left the

market, leaving us as one of the few remaining companies offering this product. We decided to remain in

these counties in Ohio because we believe we have a critical mass of membership and can continue to

achieve improved results. We withdrew, effective on January 1, 2002, from the Medicare + Choice market in

Colorado due to low membership in this market. Our Medicare + Choice membership in Colorado was

6,000 at December 31, 2001.

Individual membership increased primarily due to new business resulting from higher sales of Individual

(under age 65) products, particularly in our Midwest segment.

Self-funded membership increased primarily due to our 23% increase in BlueCard membership. Fully

insured membership, excluding TRICARE, grew by 170,000 members, or 5%, from December 31, 2000,

due to growth in both Local Large and Small Group businesses.

Our Midwest and West membership grew primarily from increases in BlueCard activity, Local Large Group

and National accounts. Our East membership growth is attributed to increased sales of Local Large Group

and growth in BlueCard. Local Large Group sales in our East segment increased primarily due to the

withdrawal of two of our largest competitors from the New Hampshire and Maine markets.

21