Anthem Blue Cross 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

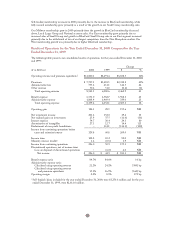

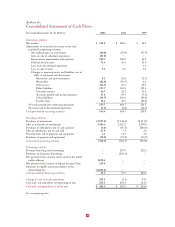

Year Ended December 31, 2000 Compared to Year Ended December 31, 1999

Net cash flow provided by operating activities was $684.5 million in 2000 and $219.8 million in 1999, an

increase of $464.7 million, or 211%. Significant growth occurred in the amount of net income, increased

depreciation and amortization expense related to acquisitions, amortization of a new claims and

administration system in our Midwest region and better balance sheet management resulting from our

conversion of certain operating assets, such as receivables and investments in non-strategic assets, to cash.

These activities contributed $256.4 million of additional operating cash in 2000. The year 1999 included

the following non-recurring disbursements of $156.0 million: payments for the settlement of charitable asset

claims in the states of Ohio, Kentucky and Connecticut and the settlement with the OIG, Health and

Human Services, with respect to BCBS-CT.

Net cash used in investing activities was $761.1 million in 2000 and $356.8 million in 1999, an increase of

$404.3 million, or 113%, primarily from our increased operating cash flow in 2000. Additionally, the net

cash we paid to acquire BCBS-ME and other purchase price adjustments paid with respect to prior

acquisitions in 2000 resulted in a decrease of approximately $161.7 million in cash used for investing

activities, as compared to 1999 when we purchased BCBS-NH and BCBS-CO/NV.

Net cash provided by financing activities was $75.5 million in 2000 and $220.1 million in 1999, a decrease

of $144.6 million or 66%. The cash provided in 2000 was the net proceeds received from our issuance of

$295.9 million of surplus notes on a discounted basis less $220.4 million repayment of bank debt.

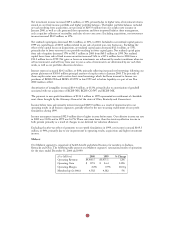

Future Liquidity

Additional future liquidity needs may include acquisitions, operating expenses, common stock repurchases

and capital contributions to our subsidiaries and will include interest and contract fee payments on our

Units. We anticipate that we will purchase BCBS-KS with cash flow from current operations, pending the

outcome of the appeal of the Kansas Insurance Commissioner’s decision (see Note 21 to our audited

consolidated financial statments). We plan to utilize all or any combination of the following to fund our

liquidity needs: cash flow from operations, our investment portfolio, new borrowings under our credit

facilities, and future equity and debt offerings. Our source of liquidity would be determined at the time of

need, based on market conditions at that time. For additional information on our future debt and lease

commitments, see Notes 6 and 15 to our audited consolidated financial statements.

Investment Portfolio

Our investment portfolio is carried at fair value. As a result, we evaluate our investment securities on a

quarterly basis, using both quantitative and qualitative factors, to determine whether a decline in value is

other than temporary. If any declines are determined to be other than temporary, we charge the losses to

income. At December 31, 2001, we had gross unrealized gains of $90.4 million and gross unrealized losses

of $18.4 million, none of which were deemed to be other than temporary.

Dividends from Subsidiaries

The ability of our licensed insurance company subsidiaries to pay dividends to their parent companies is

limited by regulations in their respective states of domicile. Generally, dividends in any 12-month period are

limited to the greater or lesser (depending on state statute) of the prior year’s statutory net income or 10%

of statutory surplus. Dividends in excess of this amount are classified as extraordinary and require prior

approval of the respective departments of insurance. Further, an insurance company may not pay a dividend

unless, after such payment, its surplus is reasonable in relation to its outstanding liabilities and adequate to

meet its financial needs, as determined by the department of insurance.

37