Anthem Blue Cross 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

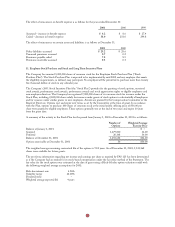

The effect of reinsurance on benefit expense is as follows for the years ended December 31:

2001 2000 1999

Assumed – increase in benefit expense $ 6.2 $ 8.6 $ 27.4

Ceded – decrease in benefit expense 38.0 233.0 299.8

The effect of reinsurance on certain assets and liabilities is as follows at December 31:

2001 2000

Policy liabilities assumed $ 29.2 $ 28.6

Unearned premiums assumed 0.7 0.2

Premiums payable ceded 7.8 8.5

Premiums receivable assumed 0.3 0.3

11. Employee Stock Purchase and Stock and Long Term Incentive Plans

The Company has reserved 3,000,000 shares of common stock for the Employee Stock Purchase Plan (“Stock

Purchase Plan”). The Stock Purchase Plan is expected to be implemented by mid 2002 and any employee that meets

the eligibility requirements, as defined, may participate. No employee will be permitted to purchase more than twenty

five thousand dollars of stock in any calendar year.

The Company’s 2001 Stock Incentive Plan (the “Stock Plan”) provides for the granting of stock options, restricted

stock awards, performance stock awards, performance awards and stock appreciation rights to eligible employees and

non-employee directors. The Company has registered 7,000,000 shares of its common stock for issuance under the

Stock Plan, including 2,000,000 shares solely for issuance under grants of stock options to substantially all employees

and for issuance under similar grants to new employees. Awards are granted by the Compensation Committee of the

Board of Directors. Options vest and expire over terms as set by the Committee at the time of grant. In accordance

with the Plan, options to purchase 100 shares of common stock at the initial public offering price of $36.00 per

share were granted to eligible employees. These options generally vest at the end of two years and expire 10 years

from the grant date.

A summary of the activity in the Stock Plan for the period from January 1, 2001 to December 31, 2001 is as follows:

Number of Weighted Average

Options Exercise Price

Balance at January 1, 2001 – $ –

Granted 1,479,000 36.00

Forfeited 20,368 36.00

Balance at December 31, 2001 1,458,632 $36.00

Options exercisable at December 31, 2001 36 $36.00

The weighted average remaining contractual life of the options is 9.83 years. As of December 31, 2001, 5,541,368

shares were available for future grants.

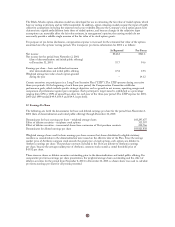

The pro forma information regarding net income and earnings per share as required by FAS 123 has been determined

as if the Company had accounted for its stock-based compensation under the fair value method of the Statement. The

fair value for the stock options was estimated at the date of grant using a Black-Scholes option-valuation model with

the following weighted average assumptions for 2001:

Risk-free interest rate 4.96%

Volatility factor 42.00%

Dividend yield –

Weighted average expected life 4 years