Anthem Blue Cross 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

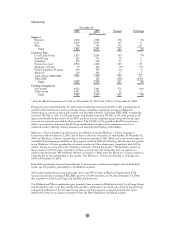

Premiums increased by $2,318.8 million, or 43%, to $7,737.3 million in 2000 primarily due to our

acquisitions of BCBS-NH and BCBS-CO/NV in the fourth quarter of 1999 and BCBS-ME in June 2000.

Excluding these acquisitions, premiums increased by $870.5 million, or 16%, primarily due to premium rate

increases and higher membership in our Midwest and East segments. Our Midwest premiums increased

$473.8 million, or 13%, while our East premiums increased $353.4 million, or 25%. Midwest premiums

increased primarily due to higher membership and premium rate increases in our group accounts (both

Local Large Group and Small Group) and higher membership in Medicare + Choice. East premiums

increased primarily due to premium rate increases and higher membership in group business, as well as the

conversion of the State of Connecticut account to fully insured from self-funded status in mid-1999.

Administrative fees increased $144.5 million, or 24%, from $611.1 million in 1999 to $755.6 million in

2000, with $135.3 million of this increase resulting from our acquisitions of BCBS-NH, BCBS-CO/NV

and BCBS-ME. In July 1999, we sold two non-strategic businesses which had combined 1999 revenues of

$12.8 million. Excluding these acquisitions and divestitures, administrative fees increased $20.6 million, or

3%, primarily from membership growth in National account business. Excluding these acquisitions and

divestitures, other revenue increased $6.0 million, or 14%, primarily due to Anthem Alliance assuming

additional administrative functions under the TRICARE program.

Benefit expense increased $1,968.3 million, or 43%, in 2000, primarily due to acquisitions. Excluding our

acquisitions, benefit expense increased $729.9 million, or 16%, due to increasing cost of care and the effect

of higher average membership throughout the year. Cost of care trends were driven primarily by higher

utilization of outpatient services and higher prescription drug costs. Our benefit expense ratio increased

10 basis points from 84.6% in 1999 to 84.7% in 2000 due to our acquisition of BCBS-ME in 2000, which

had a higher benefit expense ratio than our other operations. Excluding acquisitions, our benefit expense

ratio remained constant at 84.6% in 2000 and 1999.

Outpatient cost increases in our segments ranged from 15% to 20% in 2000 over 1999. These increases have

resulted from both increased utilization and higher unit costs. Increased outpatient utilization reflects an

industry-wide trend toward a broader range of medical procedures being performed without overnight

hospital stays, as well as an increasing customer awareness of and demand for diagnostic procedures such as

MRIs. In addition, improved medical technology has allowed more complicated medical procedures to be

performed on an outpatient basis rather than on an inpatient (hospitalized) basis, increasing both outpatient

utilization rates and unit costs.

Prescription drug cost increases have varied among regions and by product, but generally ranged from 12%

to 20% in 2000 over 1999, primarily due to introduction of new, higher cost drugs as well as higher overall

utilization as a result of increases in direct-to-consumer advertising by pharmaceutical companies. In

response to increasing prescription drug costs, we implemented a three-tiered drug program and expanded

the use of formularies for our members.

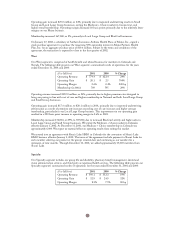

Administrative expense increased $339.0 million, or 23%, in 2000, primarily due to our acquisitions of

BCBS-NH, BCBS-CO/NV and BCBS-ME. Administrative expense in 1999 included $41.9 million

resulting from our settlement with the Office of Inspector General, or OIG, Health and Human Services to

resolve an investigation into alleged misconduct in the Medicare fiscal intermediary operations in

Connecticut during periods preceding Blue Cross and Blue Shield of Connecticut’s, or BCBS-CT’s, merger

with Anthem. Excluding acquisitions and the effect of the OIG settlement, administrative expense

increased $75.6 million, or 5%, primarily due to higher commissions and premium taxes, which vary

with premium and higher incentive compensation costs. Additionally, in December 2000, we made a

$20.0 million contribution to Anthem Foundation, Inc., which is a charitable and educational not-for-profit

corporation. Excluding these costs, administrative expense would have been down slightly in 2000 due to

productivity improvements resulting from our ongoing efforts to identify and implement more efficient

processes in our customer service and claims operations.

Our administrative expense ratio decreased 160 basis points primarily due to operating revenues increasing

faster than administrative expense. Excluding acquisitions and the effect of the OIG settlement, our

administrative expense ratio would have decreased 120 basis points.

30