Anthem Blue Cross 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

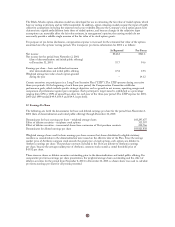

The Black-Scholes option-valuation model was developed for use in estimating the fair value of traded options which

have no vesting restrictions and are fully transferable. In addition, option valuation models require the input of highly

subjective assumptions including the expected stock price volatility. Because the Company’s stock option grants have

characteristics significantly different from those of traded options, and because changes in the subjective input

assumptions can materially affect the fair value estimate, in management’s opinion, the existing models do not

necessarily provide a reliable single measure of the fair value of its stock option grants.

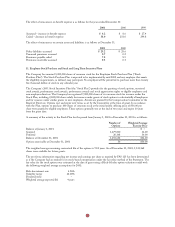

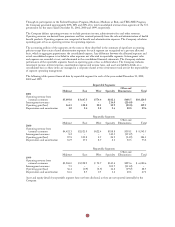

For purposes of pro forma disclosures, compensation expense is increased for the estimated fair value of the options

amortized over the options’ vesting periods. The Company’s pro forma information for 2001 is as follows:

As Reported Pro Forma

Net income $342.2 $341.1

Net income for the period from November 2, 2001

(date of demutualization and initial public offering)

to December 31, 2001 55.7 54.6

Earnings per share – basic and diluted net income

after demutualization and initial public offering 0.54 0.53

Weighted average fair value of each option granted

during the year – 14.12

Certain executives are participants in a Long Term Incentive Plan (“LTIP”). The LTIP operates during successive

three-year periods. At the beginning of each three-year period, the Compensation Committee establishes

performance goals, which include specific strategic objectives such as growth in net income, operating margin and

comparison of performance against peer companies. Each participant’s target award is established as a percentage

ranging from 30% to 150% of annual base salary for each year of the three-year period. The LTIP expense for 2001,

2000 and 1999 totaled $49.9, $50.9 and $14.9, respectively.

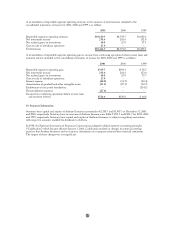

12. Earnings Per Share

The following sets forth the denominator for basic and diluted earnings per share for the period from November 2,

2001 (date of demutualization and initial public offering) through December 31, 2001:

Denominator for basic earnings per share – weighted average shares 103,295,675

Effect of dilutive securities – employee stock options 313,397

Effect of dilutive securities – incremental shares from conversion of Unit purchase contracts 212,766

Denominator for diluted earnings per share 103,821,838

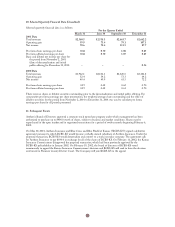

Weighted average shares used for basic earnings per share assumes that shares distributed to eligible statutory

members as consideration in the demutualization were issued on the effective date of the Plan. Since the average

market price of Anthem’s common stock exceeds the grant price of stock options, such options are dilutive to

Anthem’s earnings per share. The purchase contracts included in the Units are dilutive to Anthem’s earnings

per share, because the average market price of Anthem’s common stock exceeds a stated threshold price of

$43.92 per share.

There were no shares or dilutive securities outstanding prior to the demutualization and initial public offering. For

comparative pro forma earnings per share presentation, the weighted average shares outstanding and the effect of

dilutive securities for the period from November 2, 2001 to December 31, 2001 as shown above was used to calculate

pro forma earnings per share for all periods presented.