Anthem Blue Cross 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Stock-Based Compensation: The Company has a plan that provides for the award of stock options to employees. Stock

options are granted for a fixed number of shares with an exercise price at least equal to the fair value of the shares at

the date of grant. The Company accounts for stock options using Accounting Principles Board Opinion No. 25,

Accounting for Stock Issued to Employees, and, accordingly, recognizes no compensation expense related to stock options.

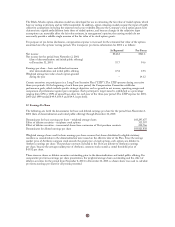

Earnings Per Share: Earnings per share amounts, on a basic and diluted basis, have been calculated based upon the

weighted average common shares outstanding or deemed to be outstanding for the period after the date of the

demutualization and initial public offering.

Basic earnings per share excludes dilution and is computed by dividing income available to common shareholders by

the weighted average number of common shares outstanding for the period. Diluted earnings per share includes the

dilutive effect of all stock options and purchase contracts included in Equity Security Units, using the treasury stock

method. Under the treasury stock method, exercise of stock options and purchase contracts is assumed with the

proceeds used to purchase common stock at the average market price for the period. The difference between the

number of shares assumed issued and number of shares assumed purchased represents the dilutive shares.

Reclassifications: Certain prior year balances have been reclassified to conform to the current year presentation.

2. Demutualization, Initial Public Offering and Equity Security Unit Offering

On November 2, 2001, the date the Conversion became effective, all membership interests in Anthem Insurance were

extinguished and the eligible statutory members of Anthem Insurance became entitled to receive consideration in the

form of Anthem’s common stock or cash, as provided in the Conversion.

The Conversion required an initial public offering of common stock and provided for other capital raising

transactions on the effective date of the Conversion. On the Conversion effective date, Anthem completed an initial

public offering of 55,200,000 shares of common stock at an initial public offering price of $36.00 per share. The

shares issued in the initial public offering are in addition to 48,095,675 shares of common stock (which will

ultimately vary slightly when all distribution issues are finalized) distributed to eligible statutory members in the

demutualization.

Concurrent with the initial public offering of common stock noted above, Anthem issued 4,600,000 of 6.00% Equity

Security Units (“Units”). Each Unit contains a purchase contract under which the holder agrees to purchase, for fifty

dollars, shares of common stock of Anthem on November 15, 2004, and a 5.95% subordinated debenture (see Note 6).

The number of shares to be purchased will be determined based on the average trading price of Anthem common

stock at the time of settlement. In addition, Anthem will pay quarterly contract fee payments on the purchase

contracts at the annual rate of 0.05% of the stated amount of $50.00 per purchase contract, subject to Anthem’s rights

to defer these payments.

After underwriting discount and other offering and demutualization expenses, net proceeds from the common stock

offering were approximately $1,862.8. After underwriting discount and expenses, net proceeds from the Units offering

were approximately $219.8. In December 2001, proceeds from the common stock and Units offerings in the amount

of $2,063.6 were used to fund payments to eligible statutory members of Anthem Insurance who received cash

instead of common stock in the demutualization.

3. Acquisitions, Divestitures and Discontinued Operations

Acquisitions:

Pending

On January 17, 2002, a subsidiary of Anthem Insurance, Anthem Health Plans of Maine, Inc., signed a stock

purchase agreement to purchase the remaining 50% ownership interest in Maine Partners Health Plan, Inc. for an

aggregate purchase price of $10.6. Subject to terms and conditions of the agreement, the transaction is expected to

close in the first quarter of 2002.