Advance Auto Parts 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

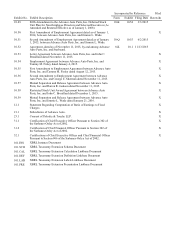

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-44

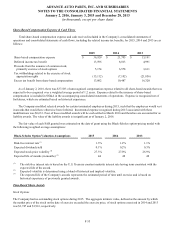

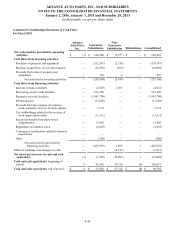

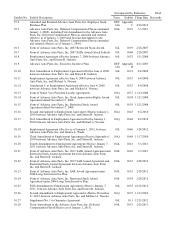

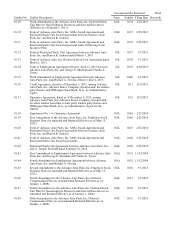

Condensed Consolidating Statements of Cash Flows

For Fiscal 2015

Advance

Auto Parts,

Inc.

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Net cash (used in) provided by operating

activities $ (1) $ 696,580 $ (6,937) $ — $ 689,642

Cash flows from investing activities:

Purchases of property and equipment — (232,591)(2,156)—

(234,747)

Business acquisitions, net of cash acquired — (18,583)(306)—

(18,889)

Proceeds from sales of property and

equipment — 266 4 — 270

Net cash used in investing activities — (250,908)(2,458)—

(253,366)

Cash flows from financing activities:

Increase in bank overdrafts — (4,529) 1,606 1 (2,922)

Borrowings under credit facilities — 618,300 — — 618,300

Payments on credit facilities — (1,041,700)— —

(1,041,700)

Dividends paid — (17,649)— —

(17,649)

Proceeds from the issuance of common

stock, primarily exercise of stock options — 5,174 — — 5,174

Tax withholdings related to the exercise of

stock appreciation rights — (13,112)— —

(13,112)

Excess tax benefit from share-based

compensation — 13,002 — — 13,002

Repurchase of common stock — (6,665)— —

(6,665)

Contingent consideration related to business

acquisitions — — — — —

Other — (380)— —(380)

Net cash (used in) provided by

financing activities — (447,559) 1,606 1 (445,952)

Effect of exchange rate changes on cash — — (4,213)—

(4,213)

Net (decrease) increase in cash and cash

equivalents (1) (1,887)(12,002)1

(13,889)

Cash and cash equivalents, beginning of

period 9 65,345 39,326 (9) 104,671

Cash and cash equivalents, end of period $ 8 $ 63,458 $ 27,324 $ (8) $ 90,782