Advance Auto Parts 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

interest to the repurchase date. The Notes are currently fully and unconditionally guaranteed, jointly and severally, on an

unsubordinated and unsecured basis by each of the subsidiary guarantors. We will be permitted to release guarantees without

the consent of holders of the Notes under the circumstances described in the Indenture: (i) upon the release of the guarantee of

our other debt that resulted in the affected subsidiary becoming a guarantor of this debt; (ii) upon the sale or other disposition of

all or substantially all of the stock or assets of the subsidiary guarantor; or (iii) upon our exercise of our legal or covenant

defeasance option.

The Indenture contains customary provisions for events of default including for: (i) failure to pay principal or interest when

due and payable; (ii) failure to comply with covenants or agreements in the Indenture or the Notes and failure to cure or obtain

a waiver of such default upon notice; (iii) a default under any debt for money borrowed by us or any of our subsidiaries that

results in acceleration of the maturity of such debt, or failure to pay any such debt within any applicable grace period after final

stated maturity, in an aggregate amount greater than $25.0 million without such debt having been discharged or acceleration

having been rescinded or annulled within 10 days after receipt by us of notice of the default by the Trustee or holders of not

less than 25% in aggregate principal amount of the Notes then outstanding; and (iv) events of bankruptcy, insolvency or

reorganization affecting us and certain of our subsidiaries. In the case of an event of default, the principal amount of the Notes

plus accrued and unpaid interest may be accelerated. The Indenture also contains covenants limiting the ability of us and our

subsidiaries to incur debt secured by liens and to enter into sale and lease-back transactions.

As of January 2, 2016, we had a credit rating from Standard & Poor’s of BBB- and from Moody’s Investor Service of

Baa2. The current outlooks by Standard & Poor’s and Moody’s are both stable. The current pricing grid used to determine our

borrowing rate under our revolving credit facility is based on our credit ratings. If these credit ratings decline, our interest rate

on outstanding balances may increase and our access to additional financing on favorable terms may become more limited. In

addition, it could reduce the attractiveness of our vendor payment program, where certain of our vendors finance payment

obligations from us with designated third party financial institutions, which could result in increased working capital

requirements. Conversely, if these credit ratings improve, our interest rate may decrease.

Off-Balance-Sheet Arrangements

We guarantee loans made by banks to various of our independent store customers totaling $29.7 million as of January 2,

2016. These loans are collateralized by security agreements on merchandise inventory and other assets of the borrowers. We

believe the likelihood of performance under these guarantees is remote and that the fair value of these guarantees is very

minimal. As of January 2, 2016, we had no other off-balance-sheet arrangements as defined in Regulation S-K Item 303 of the

SEC regulations. We include other off-balance-sheet arrangements in our Contractual Obligations table including operating

lease payments, interest payments on our Notes and revolving credit facility and letters of credit outstanding.

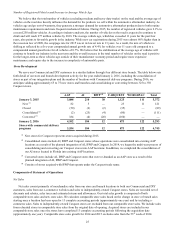

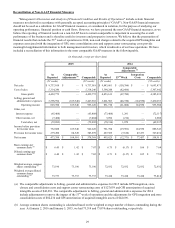

Contractual Obligations

In addition to our Notes and revolving credit facility, we utilize operating leases as another source of financing. The

amounts payable under these operating leases are included in our schedule of contractual obligations. Our future contractual

obligations related to long-term debt, operating leases and other contractual obligations as of January 2, 2016 were as follows:

Payments Due by Period

Contractual Obligations Total

Less than

1 Year 1 - 3 Years 3 - 5 Years

More Than

5 Years

(in thousands)

Long-term debt (1) $ 1,213,759 $ 598 $ 80,000 $ 379,377 $ 753,784

Interest payments 342,444 54,141 109,875 97,499 80,929

Operating leases (2) 3,250,507 491,602 830,492 678,742 1,249,671

Other long-term liabilities (3) 663,279 — — — —

Purchase obligations (4) 43,629 23,805 9,664 3,870 6,290

$ 5,513,618 $ 570,146 $ 1,030,031 $ 1,159,488 $ 2,090,674

Note: For additional information refer to Note 7, Long-term Debt; Note 13, Income Taxes; Note 14, Lease Commitments; Note

15, Contingencies; and Note 16, Benefit Plans, in the Notes to Consolidated Financial Statements, included in Item 15.

Exhibits, Financial Statement Schedules, of this Annual Report on Form 10-K.