Advance Auto Parts 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-19

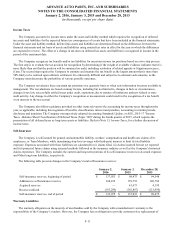

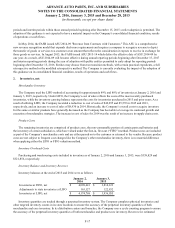

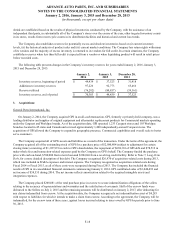

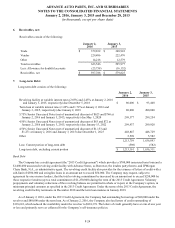

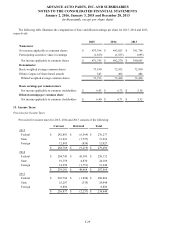

Purchase Price Allocation

The following table summarizes the consideration paid for GPI and the amounts of the assets acquired and liabilities

assumed as of the acquisition date:

Total Consideration $ 2,080,804

Recognized amounts of identifiable assets

acquired and liabilities assumed

Cash and cash equivalents $ 25,176

Receivables 255,997

Inventory 1,159,886

Other current assets 118,871

Property, plant and equipment 162,545

Intangible assets 756,571

Other assets 1,741

Accounts payable (704,006)

Accrued and other current liabilities (136,784)

Long-term liabilities (356,584)

Total identifiable net assets 1,283,413

Goodwill 797,391

Total acquired net assets $ 2,080,804

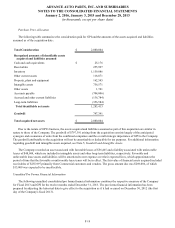

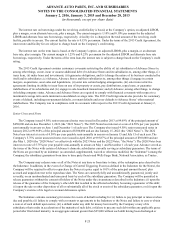

Due to the nature of GPI's business, the assets acquired and liabilities assumed as part of this acquisition are similar in

nature to those of the Company. The goodwill of $797,391 arising from the acquisition consists largely of the anticipated

synergies and economies of scale from the combined companies and the overall strategic importance of GPI to the Company.

The goodwill attributable to the acquisition will not be amortizable or deductible for tax purposes. For additional information

regarding goodwill and intangible assets acquired, see Note 5, Goodwill and Intangible Assets.

The Company recorded an asset associated with favorable leases of $56,465 and a liability associated with unfavorable

leases of $48,604, which are included in intangible assets and other long-term liabilities, respectively. Favorable and

unfavorable lease assets and liabilities will be amortized to rent expense over their expected lives, which approximates the

period of time that the favorable or unfavorable lease terms will be in effect. The fair value of financial assets acquired included

receivables of $255,997 primarily from Commercial customers and vendors. The gross amount due was $269,006, of which

$13,009 was expected to be uncollectible.

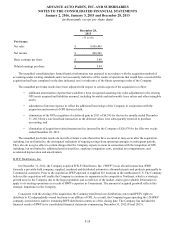

Unaudited Pro Forma Financial Information

The following unaudited consolidated pro forma financial information combines the respective measure of the Company

for Fiscal 2013 and GPI for the twelve months ended December 31, 2013. The pro forma financial information has been

prepared by adjusting the historical data to give effect to the acquisition as if it had occurred on December 30, 2012 (the first

day of the Company's fiscal 2013).