Advance Auto Parts 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-32

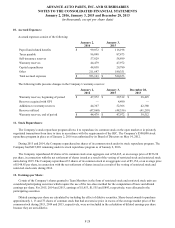

The Company files a U.S. federal income tax return and income tax returns in various states and foreign jurisdictions. The

U.S. Internal Revenue Service has completed exams of the U.S. federal income tax returns for years 2007 and prior. With few

exceptions, the Company is no longer subject to state and local or non-U.S. income tax examinations by tax authorities for

years before 2008.

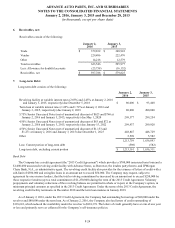

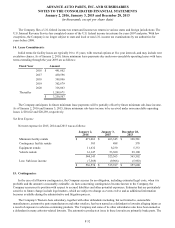

14. Lease Commitments:

Initial terms for facility leases are typically 10 to 15 years, with renewal options at five year intervals, and may include rent

escalation clauses. As of January 2, 2016, future minimum lease payments due under non-cancelable operating leases with lease

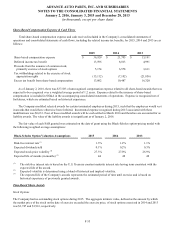

terms extending through the year 2059 are as follows:

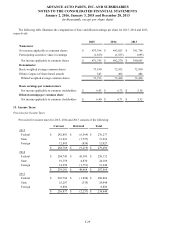

Fiscal Year Amount

2016 $ 491,602

2017 430,596

2018 399,896

2019 362,679

2020 316,063

Thereafter 1,249,671

$ 3,250,507

The Company anticipates its future minimum lease payments will be partially off-set by future minimum sub-lease income.

As of January 2, 2016 and January 3, 2015, future minimum sub-lease income to be received under non-cancelable operating

leases is $18,622 and $20,289, respectively.

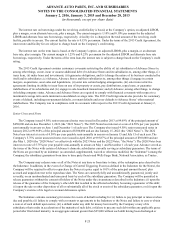

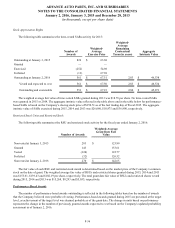

Net Rent Expense

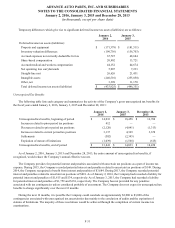

Net rent expense for 2015, 2014 and 2013 was as follows:

January 2,

2016

January 3,

2015

December 28,

2013

Minimum facility rentals $ 471,061 $ 463,345 $ 328,581

Contingency facility rentals 303 488 578

Equipment rentals 11,632 8,230 5,333

Vehicle rentals 61,147 53,300 29,100

544,143 525,363 363,592

Less: Sub-lease income (7,569)(9,966)(5,983)

$ 536,574 $ 515,397 $ 357,609

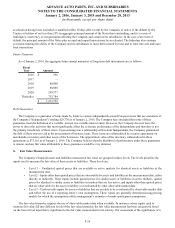

15. Contingencies:

In the case of all known contingencies, the Company accrues for an obligation, including estimated legal costs, when it is

probable and the amount is reasonably estimable. As facts concerning contingencies become known to the Company, the

Company reassesses its position with respect to accrued liabilities and other potential exposures. Estimates that are particularly

sensitive to future change include legal matters, which are subject to change as events evolve and as additional information

becomes available during the administrative and litigation process.

The Company’s Western Auto subsidiary, together with other defendants including, but not limited to, automobile

manufacturers, automotive parts manufacturers and other retailers, has been named as a defendant in lawsuits alleging injury as

a result of exposure to asbestos-containing products. The Company and some of its other subsidiaries also have been named as

a defendant in many asbestos-related lawsuits. The automotive products at issue in these lawsuits are primarily brake parts. The