Advance Auto Parts 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-7

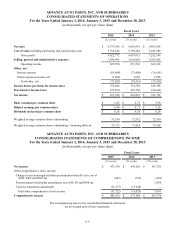

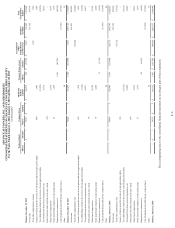

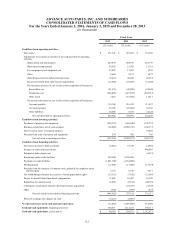

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands)

Fiscal Years

2015 2014 2013

(52 weeks) (53 weeks) (52 weeks)

Cash flows from operating activities:

Net income $ 473,398 $ 493,825 $ 391,758

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization 269,476 284,693 207,795

Share-based compensation 36,929 21,705 13,191

Loss on property and equipment, net 12,882 13,281 1,599

Other 2,660 2,631 1,679

(Benefit) provision for deferred income taxes (9,219) 48,468 (2,237)

Excess tax benefit from share-based compensation (13,002) (10,487) (16,320)

Net (increase) decrease in, net of effect from acquisition of businesses:

Receivables, net (21,476) (48,209) (32,428)

Inventories, net (244,096) (227,657) (203,513)

Other assets 7,423 (63,482) 11,011

Net increase (decrease) in, net of effect from acquisition of businesses:

Accounts payable 119,164 216,412 113,497

Accrued expenses 35,103 (28,862) 63,346

Other liabilities 20,400 6,673 (4,128)

Net cash provided by operating activities 689,642 708,991 545,250

Cash flows from investing activities:

Purchases of property and equipment (234,747) (228,446) (195,757)

Business acquisitions, net of cash acquired (18,889) (2,060,783) (186,137)

Sale of certain assets of acquired business — — 19,042

Proceeds from sales of property and equipment 270 992 745

Net cash used in investing activities (253,366) (2,288,237) (362,107)

Cash flows from financing activities:

(Decrease) increase in bank overdrafts (2,922) 16,219 (2,926)

Issuance of senior unsecured notes — — 448,605

Payment of debt related costs — — (8,815)

Borrowings under credit facilities 618,300 2,238,200 —

Payments on credit facilities (1,041,700) (1,654,800) —

Dividends paid (17,649) (17,580) (17,574)

Proceeds from the issuance of common stock, primarily for employee stock

purchase plan 5,174 6,578 3,611

Tax withholdings related to the exercise of stock appreciation rights (13,112) (7,102) (21,856)

Excess tax benefit from share-based compensation 13,002 10,487 16,320

Repurchase of common stock (6,665) (5,154) (80,795)

Contingent consideration related to previous business acquisition — (10,047) (4,726)

Other (380) (890) (627)

Net cash (used in) provided by financing activities (445,952) 575,911 331,217

Effect of exchange rate changes on cash (4,213) (4,465) —

Net (decrease) increase in cash and cash equivalents (13,889) (1,007,800) 514,360

Cash and cash equivalents, beginning of period 104,671 1,112,471 598,111

Cash and cash equivalents, end of period $ 90,782 $ 104,671 $ 1,112,471