Advance Auto Parts 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-20

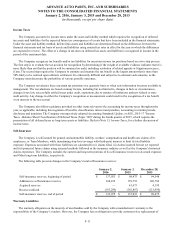

December 28,

2013

(52 weeks)

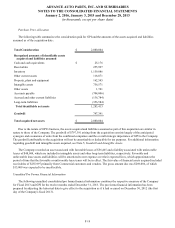

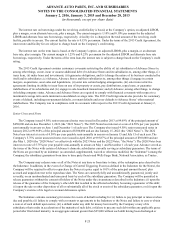

Pro forma:

Net sales $ 9,456,405

Net income $ 428,562

Basic earnings per share $ 5.88

Diluted earnings per share $ 5.84

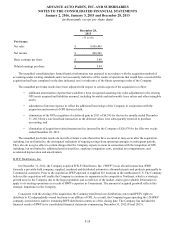

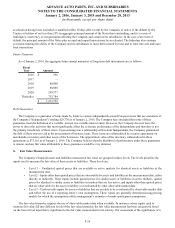

The unaudited consolidated pro forma financial information was prepared in accordance with the acquisition method of

accounting under existing standards and is not necessarily indicative of the results of operations that would have occurred if the

acquisition had been completed on the date indicated, nor is it indicative of the future operating results of the Company.

The unaudited pro forma results have been adjusted with respect to certain aspects of the acquisition to reflect:

• additional amortization expense that would have been recognized assuming fair value adjustments to the existing

GPI assets acquired and liabilities assumed, including favorable and unfavorable lease values and other intangible

assets;

• adjustment of interest expense to reflect the additional borrowings of the Company in conjunction with the

acquisition and removal of GPI historical debt;

• elimination of the GPI recognition of a deferred gain in 2013 of $6,385 for the twelve months ended December

31, 2013 from a sale leaseback transaction as the deferred values were subsequently removed in purchase

accounting; and

• elimination of acquisition-related transaction fees incurred by the Company of $26,970 for the fifty-two weeks

ended December 28, 2013.

The unaudited pro forma results do not reflect future events that either have occurred or may occur after the acquisition,

including, but not limited to, the anticipated realization of ongoing savings from operating synergies in subsequent periods.

They also do not give effect to certain charges that the Company expects to incur in connection with the integration of GPI,

including, but not limited to, additional professional fees, employee integration costs, potential asset impairments, and

accelerated depreciation and amortization.

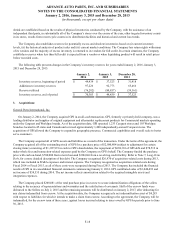

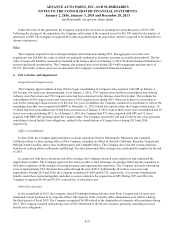

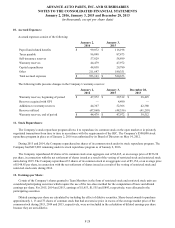

B.W.P. Distributors, Inc.

On December 31, 2012, the Company acquired B.W.P. Distributors, Inc. ("BWP") in an all-cash transaction. BWP,

formerly a privately-held company, supplied, marketed and distributed automotive aftermarket parts and products principally to

Commercial customers. Prior to the acquisition, BWP operated or supplied 216 locations in the northeastern U.S. The Company

believes this acquisition will enable the Company to continue its expansion in the competitive Northeast, which is a strategic

growth area for the Company due to the large population and overall size of the market, and to gain valuable information to

apply to its existing operations as a result of BWP's expertise in Commercial. The amount of acquired goodwill reflects this

strategic importance to the Company.

Concurrent with the closing of the acquisition, the Company transferred one distribution center and BWP's rights to

distribute to 92 independently owned locations to an affiliate of GPI. As a result, the Company began operating the 124 BWP

company-owned stores and two remaining BWP distribution centers as of the closing date. The Company has included the

financial results of BWP in its consolidated financial statements commencing December 31, 2012 (Fiscal 2013).