Advance Auto Parts 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-31

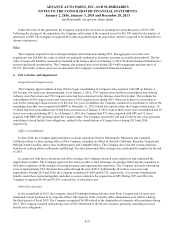

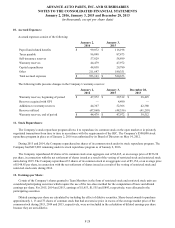

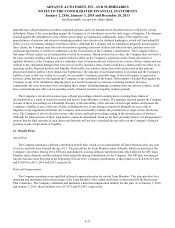

Temporary differences which give rise to significant deferred income tax assets (liabilities) are as follows:

January 2,

2016

January 3,

2015

Deferred income tax assets (liabilities):

Property and equipment $ (171,378)$ (181,511)

Inventory valuation differences (190,756)(156,703)

Accrued expenses not currently deductible for tax 67,725 48,684

Share-based compensation 20,902 13,721

Accrued medical and workers compensation 44,152 44,674

Net operating loss carryforwards 5,907 7,233

Straight-line rent 26,626 21,431

Intangible assets (240,501)(255,050)

Other, net 3,398 11,170

Total deferred income tax assets (liabilities) $ (433,925)$ (446,351)

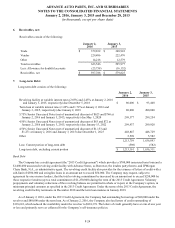

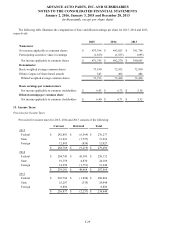

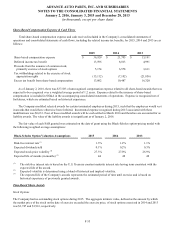

Unrecognized Tax Benefits

The following table lists each category and summarizes the activity of the Company’s gross unrecognized tax benefits for

the fiscal years ended January 2, 2016, January 3, 2015 and December 28, 2013:

January 2,

2016

January 3,

2015

December 28,

2013

Unrecognized tax benefits, beginning of period $ 14,033 $ 18,458 $ 16,708

Increases related to prior period tax positions 412 — —

Decreases related to prior period tax positions (2,120)(4,841)(1,313)

Increases related to current period tax positions 3,137 4,329 3,678

Settlements (582)(2,345)—

Expiration of statute of limitations (1,039)(1,568)(615)

Unrecognized tax benefits, end of period $ 13,841 $ 14,033 $ 18,458

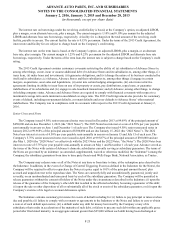

As of January 2, 2016, January 3, 2015 and December 28, 2013, the entire amount of unrecognized tax benefits, if

recognized, would reduce the Company’s annual effective tax rate.

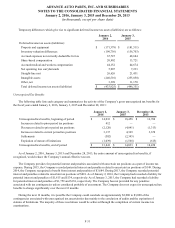

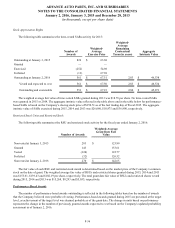

The Company provides for potential interest and penalties associated with uncertain tax positions as a part of income tax

expense. During 2015, the Company recorded potential interest and penalties related to uncertain tax positions of $149. During

2014, the Company recognized a benefit from interest and penalties of $3,684. During 2013, the Company recorded potential

interest and penalties related to uncertain tax positions of $818. As of January 2, 2016, the Company had recorded a liability for

potential interest and penalties of $1,815 and $134, respectively. As of January 3, 2015, the Company had recorded a liability

for potential interest and penalties of $1,759 and $138, respectively. The Company has not provided for any penalties

associated with tax contingencies unless considered probable of assessment. The Company does not expect its unrecognized tax

benefits to change significantly over the next 12 months.

During the next 12 months, it is possible the Company could conclude on approximately $2,000 to $3,000 of the

contingencies associated with unrecognized tax uncertainties due mainly to the conclusion of audits and the expiration of

statutes of limitations. The majority of these resolutions would be achieved through the completion of current income tax

examinations.