Advance Auto Parts 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

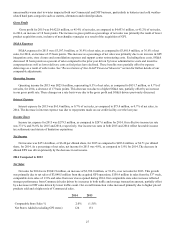

Long-Term Debt

Bank Debt

On December 5, 2013, we entered into a new credit agreement (the "2013 Credit Agreement") which provides a $700.0

million unsecured term loan and a $1.0 billion unsecured revolving credit facility with Advance Stores Company, Inc.

("Advance Stores"), as Borrower, the lenders party thereto, and JPMorgan Chase Bank, N.A., as administrative agent. The new

revolving credit facility also provides for the issuance of letters of credit with a sub-limit of $300.0 million and swingline loans

in an amount not to exceed $50.0 million. We may request, subject to agreement by one or more lenders, that the total revolving

commitment be increased by an amount not to exceed $250.0 million by those respective lenders (up to a total commitment of

$1.25 billion) during the term of the 2013 Credit Agreement. Voluntary prepayments and voluntary reductions of the revolving

balance are permitted in whole or in part, at our option, in minimum principal amounts as specified in the 2013 Credit

Agreement. Under the terms of the 2013 Credit Agreement, the revolving credit facility terminates in December 2018 and the

term loan matures in January 2019.

As of January 2, 2016, under the 2013 Credit Agreement, we had outstanding borrowings of $80.0 million under the

revolver and $80.0 million under the term loan. As of January 2, 2016, we also had letters of credit outstanding of $118.6

million, which reduced the availability under the revolver to $801.4 million. The letters of credit generally have a term of one

year or less and primarily serve as collateral for our self-insurance policies.

The interest rate on borrowings under the revolving credit facility is based, at our option, on adjusted LIBOR, plus a

margin, or an alternate base rate, plus a margin. The current margin is 1.10% and 0.10% per annum for the adjusted LIBOR and

alternate base rate borrowings, respectively. A facility fee is charged on the total amount of the revolving credit facility, payable

in arrears. The current facility fee rate is 0.15% per annum. Under the terms of the 2013 Credit Agreement, the interest rate and

facility fee are subject to change based on our credit rating.

The interest rate on the term loan is based, at our option, on adjusted LIBOR, plus a margin, or an alternate base rate, plus

a margin. The current margin is 1.25% and 0.25% per annum for the adjusted LIBOR and alternate base rate borrowings,

respectively. Under the terms of the term loan, the interest rate is subject to change based on our credit rating.

The 2013 Credit Agreement contains customary covenants restricting the ability of: (a) subsidiaries of Advance Stores to,

among other things, create, incur or assume additional debt; (b) Advance Stores and its subsidiaries to, among other things, (i)

incur liens, (ii) make loans and investments, (iii) guarantee obligations, and (iv) change the nature of its business conducted by

itself and its subsidiaries; (c) Advance, Advance Stores and their subsidiaries to, among other things (i) engage in certain

mergers, acquisitions, asset sales and liquidations, (ii) enter into certain hedging arrangements, (iii) enter into restrictive

agreements limiting its ability to incur liens on any of its property or assets, pay distributions, repay loans, or guarantee

indebtedness of its subsidiaries, and (iv) engage in sale-leaseback transactions; and (d) Advance to, among other things, change

its holding company status. Advance and Advance Stores are required to comply with financial covenants with respect to a

maximum leverage ratio and a minimum consolidated coverage ratio. The 2013 Credit Agreement also provides for customary

events of default, including non-payment defaults, covenant defaults and cross-defaults to Advance Stores’ other material

indebtedness. We were in compliance with our covenants with respect to the 2013 Credit Agreement at January 2, 2016.

Senior Unsecured Notes

We issued 4.50% senior unsecured notes in December 2013 at 99.69% of the principal amount of $450 million which are

due December 1, 2023 (the “2023 Notes”). The 2023 Notes bear interest at a rate of 4.50% per year payable semi-annually in

arrears on June 1 and December 1 of each year. We previously issued 4.50% senior unsecured notes in January 2012 at

99.968% of the principal amount of $300 million which are due January 15, 2022 (the “2022 Notes”). The 2022 Notes bear

interest at a rate of 4.50% per year payable semi-annually in arrears on January 15 and July 15 of each year. We also previously

issued 5.75% senior unsecured notes in April 2010 at 99.587% of the principal amount of $300 million which are due May 1,

2020 (the “2020 Notes” or collectively with the 2023 Notes and the 2022 Notes, “the Notes”). The 2020 Notes bear interest at a

rate of 5.75% per year payable semi-annually in arrears on May 1 and November 1 of each year. Advance served as the issuer

of the Notes with certain of Advance's domestic subsidiaries currently serving as subsidiary guarantors. The terms of the Notes

are governed by an indenture (as amended, supplemented, waived or otherwise modified, the “Indenture”) among us, the

subsidiary guarantors from time to time party thereto and Wells Fargo Bank, National Association, as Trustee.

We may redeem some or all of the Notes at any time or from time to time, at the redemption price described in the

Indenture. In addition, in the event of a Change of Control Triggering Event (as defined in the Indenture for the Notes), we will

be required to offer to repurchase the Notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid