Advance Auto Parts 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-22

In August 2014, the Company approved plans to consolidate its 40 Autopart International ("AI") stores located in Florida

into Advance Auto Parts stores. All of the AI consolidations and conversions were complete as of the second quarter of fiscal

2015. During 2015, the Company incurred $2,700 of exit costs, consisting primarily of closed facility lease obligations,

associated with these plans.

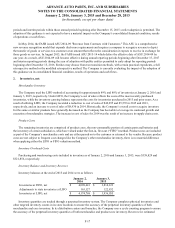

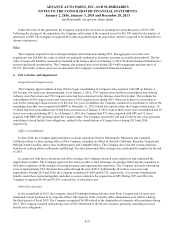

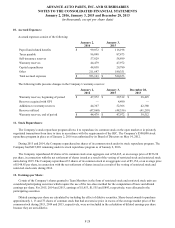

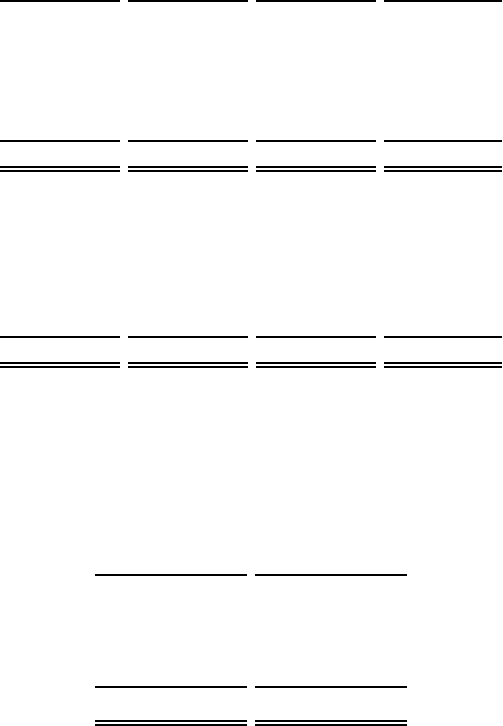

Total Restructuring Liabilities

A summary of the Company’s restructuring liabilities, which are recorded in accrued expenses (current portion) and long-

term liabilities (long-term portion) in the accompanying condensed consolidated balance sheet, are presented in the following

table:

Closed

Facility

Lease

Obligations Severance

Relocation

and Other

Exit Costs Total

Balance, January 3, 2015 $ 19,270 $ 5,804 $ 1,816 $ 26,890

Reserves established 34,699 13,351 4,419 52,469

Change in estimates (205)(2,009)—

(2,214)

Cash payments (11,274)(10,891)(5,884)(28,049)

Balance, January 2, 2016 $ 42,490 $ 6,255 $ 351 $ 49,096

Balance, December 28, 2013 $ 11,212 $ — $ — $ 11,212

Reserves acquired with GPI 3,455 — — 3,455

Reserves established 11,138 8,038 7,053 26,229

Change in estimates 1,053 (1,307)—

(254)

Cash payments (7,588)(927)(5,237)(13,752)

Balance, January 3, 2015 $ 19,270 $ 5,804 $ 1,816 $ 26,890

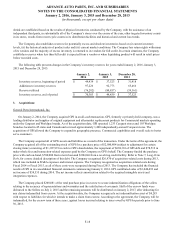

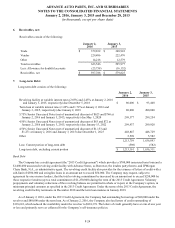

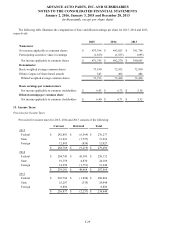

5. Goodwill and Intangible Assets:

Goodwill

The following table reflects the carrying amount of goodwill and the changes in goodwill carrying amounts.

January 2,

2016

January 3,

2015

(52 weeks ended) (53 weeks ended)

Goodwill, beginning of period $ 995,426 $ 199,835

Acquisitions 1,995 798,043

Changes in foreign currency exchange rates (7,937)(2,452)

Goodwill, end of period $ 989,484 $ 995,426

During 2015, the Company added $1,995 of goodwill associated with the acquisition of 23 stores. During 2014, the

Company acquired GPI which resulted in the addition of $797,391 of goodwill and also added $652 of goodwill associated

with the acquisition of nine stores.