Advance Auto Parts 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

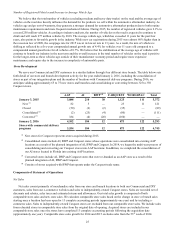

Number of Registered Vehicles and Increase in Average Vehicle Age

We believe that the total number of vehicles (excluding medium and heavy duty trucks) on the road and the average age of

vehicles on the road also heavily influence the demand for the products we sell within the automotive aftermarket industry. As

vehicles age and go out-of-warranty, they generate a stronger demand for automotive aftermarket products due to both routine

maintenance requirements and more frequent mechanical failures. During 2015, the number of registered vehicles grew 2.1% to

a record 258 million vehicles. According to industry analysts, the number of vehicles on the road is expected to continue to

climb and will reach 277 million vehicles by 2018. The average vehicle age, which has exceeded 11 years for the past four

years, also points to favorable growth in the industry. While new car registrations during 2015 were almost 60% higher than in

the recession low of 2009, the scrappage rate for 2015 was at its lowest rate in 13 years. As a result, the mix of vehicles is

shifting as reflected by a five-year compounded annual growth rate of 4.4% for vehicles over 11 years old compared to a

compounded annual growth rate for all vehicles of 0.7%. We believe that the stabilization of the average age of vehicles will

continue to benefit our industry in the near term and the overall increase in the total number of vehicles on the road is positive

for the longer-term as these vehicles age outside of their manufacturer warranty period and require more expensive

maintenance and repairs due to the increase in complexity of automobile parts.

Store Development

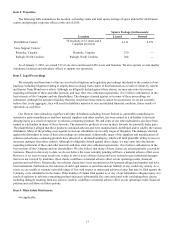

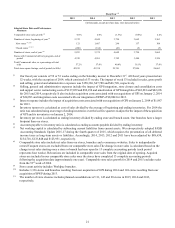

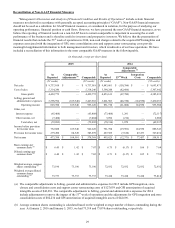

We serve our Commercial and DIY customers in a similar fashion through four different store brands. The table below sets

forth detail of our store and branch development activity for the year ended January 2, 2016, including the consolidation of

stores as part of our integration plans and the number of locations with Commercial delivery programs. During 2016, we

anticipate adding approximately 65 to 75 new stores and branches and consolidating or converting between 325 to 350

Carquest stores.

AAP AI BWP (4) CARQUEST WORLDPAC Total

January 3, 2015 3,888 210 38 1,125 111 5,372

New (1) 82 5 — 23 11 121

Closed (50) (2) (2)(35)—

(89)

Consolidated (2) (2) (25) (4)(80)—

(111)

Converted (3) 184 (4) (20)(160)——

January 2, 2016 4,102 184 12 873 122 5,293

Stores with commercial delivery

programs 3,554 184 12 873 122 4,745

(1) New stores for Carquest represents stores acquired during 2015.

(2) Consolidated stores include AI, BWP and Carquest stores whose operations were consolidated into existing AAP

locations as a result of the planned integration of AI, BWP and Carquest. In 2014, we began the multi-year process of

consolidating and converting our Carquest stores into AAP locations. In addition, we completed the consolidation of

our AI stores located in Florida into existing AAP locations.

(3) Converted stores include AI, BWP and Carquest stores that were re-branded as an AAP store as a result of the

planned integration of AI, BWP and Carquest.

(4) Consists of stores acquired with BWP that operate under the Carquest trade name.

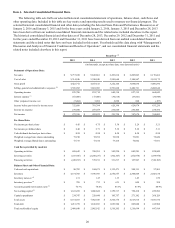

Components of Statement of Operations

Net Sales

Net sales consist primarily of merchandise sales from our store and branch locations to both our Commercial and DIY

customers, sales from our e-commerce websites and sales to independently-owned Carquest stores. Sales are recorded net of

discounts and rebates, sales taxes and estimated returns and allowances. Our total sales growth is comprised of both

comparable store sales and new store sales. We calculate comparable store sales based on the change in store or branch sales

starting once a location has been open for 13 complete accounting periods (approximately one year) and by including e-

commerce sales. Sales to independently-owned Carquest stores are excluded from our comparable store sales. We include sales

from relocated stores in comparable store sales from the original date of opening. Acquired stores are included in our

comparable store sales once the stores have completed 13 complete accounting periods following the acquisition date

(approximately one year). Comparable store sales growth for 2014 and 2015 excludes sales from the 53rd week of 2014.