Advance Auto Parts 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-23

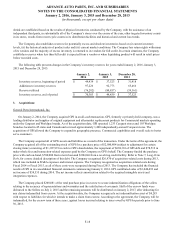

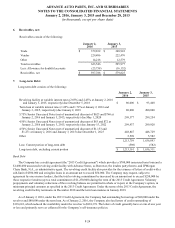

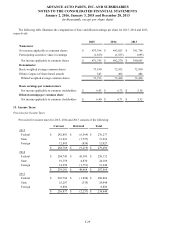

Intangible Assets Other Than Goodwill

In 2014, the Company recorded an increase to intangible assets of $757,453 related to the acquisition of GPI and nine

stores. The increase included customer relationships of $330,293 which are being amortized over 12 years, non-competes

totaling $50,695 which are being amortized over 5 years and favorable leases of $56,465 which are being amortized over the

life of the leases at a weighted average of 4.5 years. The increase also includes indefinite-lived intangibles of $320,000 from

acquired brands.

Amortization expense was $53,056, $56,499 and $7,974 for 2015, 2014 and 2013, respectively. The gross carrying

amounts and accumulated amortization of acquired intangible assets as of January 2, 2016 and January 3, 2015 are comprised

of the following:

January 2, 2016 January 3, 2015

Gross

Carrying

Amount

Accumulated

Amortization Net

Gross

Carrying

Amount

Accumulated

Amortization Net

Amortized intangible assets:

Customer relationships $ 358,655 $ (70,367) $ 288,288 $ 362,483 $ (40,609) $ 321,874

Acquired technology 8,850 (8,850) — 8,850 (8,569) 281

Favorable leases 56,040 (23,984) 32,056 56,342 (11,939) 44,403

Non-compete and other 57,430 (25,368) 32,062 56,780 (14,596) 42,184

480,975 (128,569) 352,406 484,455 (75,713) 408,742

Unamortized intangible assets:

Brands, trademark and

tradenames 334,719 — 334,719 339,383 — 339,383

Total intangible assets $ 815,694 $ (128,569) $ 687,125 $ 823,838 $ (75,713) $ 748,125

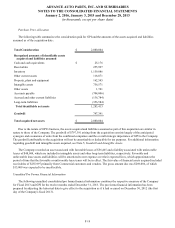

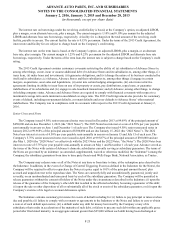

Future Amortization Expense

The table below shows expected amortization expense for the next five years for acquired intangible assets recorded as of

January 2, 2016:

Fiscal Year Amount

2016 $ 47,980

2017 45,626

2018 42,615

2019 31,855

2020 31,539

Thereafter 152,791