Advance Auto Parts 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

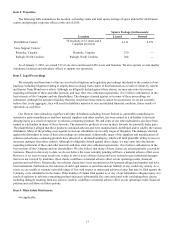

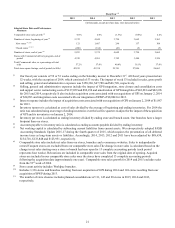

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “AAP”. The table below sets

forth the high and low sale prices per share for our common stock, as reported by the NYSE, for the fiscal periods indicated.

High Low

Fiscal Year Ended January 2, 2016

Fourth Quarter $ 201.24 $ 144.73

Third Quarter $ 194.61 $ 151.30

Second Quarter $ 169.90 $ 142.63

First Quarter $ 165.00 $ 143.02

Fiscal Year Ended January 3, 2015

Fourth Quarter $ 163.36 $ 130.14

Third Quarter $ 139.58 $ 119.71

Second Quarter $ 136.12 $ 118.51

First Quarter $ 129.99 $ 108.76

The closing price of our common stock on February 25, 2016 was $150.08. At February 25, 2016, there were 432 holders

of record of our common stock (which does not include the number of individual beneficial owners whose shares were held on

their behalf by brokerage firms in street name).

Our Board of Directors has declared a $0.06 per share quarterly cash dividend since 2006. Any payments of dividends in

the future will be at the discretion of our Board of Directors and will depend upon our results of operations, cash flows, capital

requirements and other factors deemed relevant by our Board of Directors.

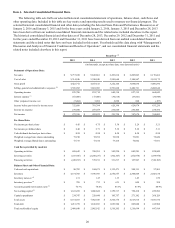

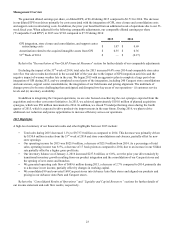

The following table sets forth information with respect to repurchases of our common stock for the fourth quarter ended

January 2, 2016 (amounts in thousands, except per share amounts):

Period

Total Number

of Shares

Purchased (1)

Average

Price Paid

per Share (1)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs (2)

Maximum Dollar

Value that May Yet

Be Purchased

Under the Plans or

Programs (2)

October 11, 2015 to November 7, 2015 — $ — — $ 415,092

November 8, 2015 to December 5, 2015 20 160.26 — 415,092

December 6, 2015 to January 2, 2016 11 148.85 — 415,092

Total 31 $ 156.22 — $ 415,092

(1) We repurchased 31,013 shares of our common stock at an aggregate cost of $4.8 million, or an average purchase price

of $156.22 per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock

units during the fourth quarter ended January 2, 2016. We did not repurchase any shares under our $500.0 million stock

repurchase program during our fourth quarter ended January 2, 2016.

(2) Our stock repurchase program authorizing the repurchase of up to $500.0 million in common stock was authorized by

our Board of Directors and publicly announced on May 14, 2012.