Advance Auto Parts 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

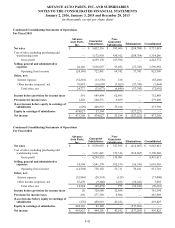

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-34

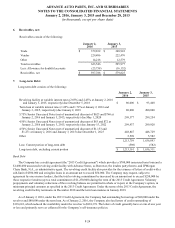

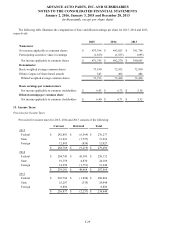

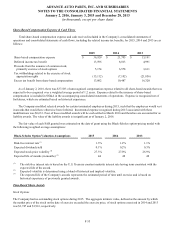

17. Share-Based Compensation:

Overview

The Company grants share-based compensation awards to its Team Members and members of its Board of Directors as

provided for under the Company’s 2014 Long-Term Incentive Plan, or 2014 LTIP, which was approved by the Company's

shareholders on May 14, 2014. Prior to May 14, 2014, the Company granted share-based compensation awards to its Team

Members under the 2004 Long-Term Incentive Plan, which expired following the approval of the 2014 LTIP. The Company

currently grants share-based compensation in the form of stock appreciation rights (“SARs”), restricted stock units ("RSUs")

and deferred stock units (“DSUs”). All remaining shares of restricted stock, which were granted prior to the transition to RSUs

in 2012, vested during 2015.

At January 2, 2016, there were 4,739 shares of common stock available for future issuance under the 2014 Plan based on

management’s current estimate of the probable vesting outcome for performance-based awards. The Company issues new

shares of common stock upon exercise of stock options and SARs. Availability is determined net of forfeitures and shares

withheld for payment of taxes due. Availability also includes shares which became available for reissuance in connection with

the exercise of SARs.

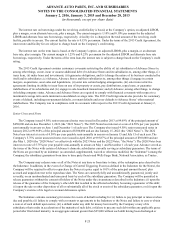

General Terms of Awards

The Company’s grants generally include both a time-based service portion and a performance-based portion, which

collectively represent the target award.

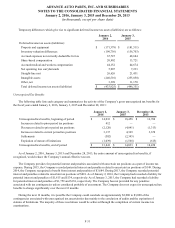

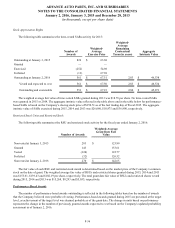

Time-Vested Awards

The Company's outstanding time-vested awards consist of SARs and RSUs. The SARs generally vest over a three-year

period in equal annual installments beginning on the first anniversary of the grant date. The SARs granted are non-qualified,

terminate on the seventh anniversary of the grant date, and contain no post-vesting restrictions other than normal trading black-

out periods prescribed by the Company’s corporate governance policies.

The RSUs and previously granted restricted stock generally vest over a three-year period in equal annual installments

beginning on the first anniversary of the grant date. During the vesting period, holders of RSUs and restricted stock are entitled

to receive dividends or in the case of RSUs, dividend equivalents, while holders of restricted stock are also entitled to voting

rights. For restricted stock, the Company's shares are considered outstanding at the date of grant, but are restricted until they

vest and cannot be sold by the recipient until the restriction has lapsed at the end of the respective vesting period.

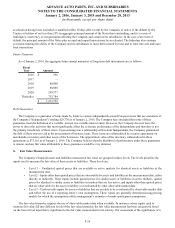

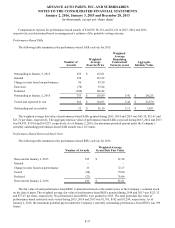

Performance-Based Awards

The Company's outstanding performance-based awards consist of SARs and RSUs. Performance awards may vest

following a three-year period subject to the Company’s achievement of certain financial goals as specified in the grant

agreements. Depending on the Company’s results during the three-year performance period, the actual number of awards

vesting at the end of the period may generally range from 75% to 200% of the target award (50% to 200% for certain officers).

Prior to the December 2013 grant, the target award for purposes of applying the performance multiple was defined as the total

award including the time-based and performance-based portions. Beginning with the December 2013 grant, the target award

for purposes of applying the performance multiple is defined solely as the performance portion of the award granted. The

performance RSUs do not have dividend equivalent rights or voting rights until the shares are earned and issued following the

applicable performance period.