Advance Auto Parts 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-27

particular item to the fair value measurement in its entirety requires judgment, including the consideration of inputs specific to

the asset or liability.

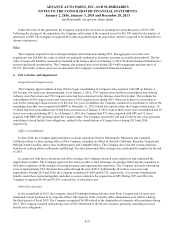

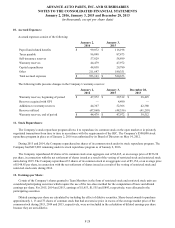

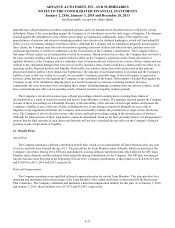

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The Company had no significant assets or liabilities that were measured at fair value on a recurring basis during 2015 or

2014.

Non-Financial Assets and Liabilities Measured at Fair Value on a Non-Recurring Basis

Certain assets and liabilities are measured at fair value on a nonrecurring basis; that is, the assets and liabilities are not

measured at fair value on an ongoing basis but are subject to fair value adjustments in certain circumstances (e.g., when there is

evidence of impairment). During 2015 and 2014, the Company recorded impairment charges of $11,017 and $11,819,

respectively, on various store and corporate assets. The remaining fair value of these assets was not significant.

Fair Value of Financial Assets and Liabilities

The carrying amount of the Company’s cash and cash equivalents, accounts receivable, bank overdrafts, accounts payable,

accrued expenses and the current portion of long term debt approximate their fair values due to the relatively short term nature

of these instruments. The fair value of the Company’s senior unsecured notes was determined using Level 2 inputs based on

quoted market prices, and the Company believes that the carrying value of its other long-term debt and certain long-term

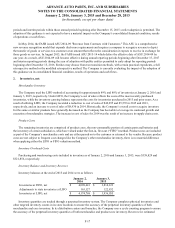

liabilities approximate fair value. The carrying value and fair value of the Company's long-term debt as of January 2, 2016 and

January 3, 2015, respectively, are as follows:

January 2,

2016

January 3,

2015

Carrying Value $ 1,213,161 $ 1,636,311

Fair Value $ 1,262,000 $ 1,728,000

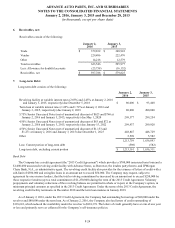

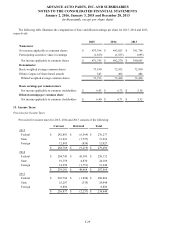

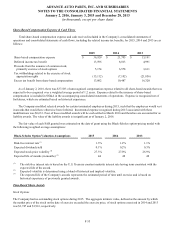

9. Property and Equipment:

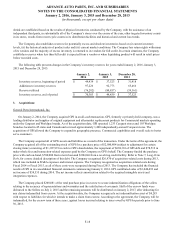

Property and equipment consists of the following:

Original

Useful Lives

January 2,

2016

January 3,

2015

Land and land improvements 0 - 10 years $ 441,048 $ 438,638

Buildings 30 - 40 years 468,237 460,187

Building and leasehold improvements 3 - 30 years 418,352 394,259

Furniture, fixtures and equipment 3 - 20 years 1,464,791 1,402,563

Vehicles 2 - 13 years 25,060 37,051

Construction in progress 106,855 71,691

2,924,343 2,804,389

Less - Accumulated depreciation (1,489,766)(1,372,359)

Property and equipment, net $ 1,434,577 $ 1,432,030

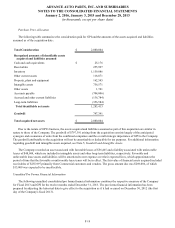

Depreciation expense was $223,728, $235,040 and $199,821 for 2015, 2014 and 2013, respectively. The Company

capitalized $13,529, $11,436 and $11,534 incurred for the development of internal use computer software during 2015, 2014

and 2013, respectively. These costs are included in the furniture, fixtures and equipment category above and are depreciated on

the straight-line method over three to ten years.