Advance Auto Parts 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

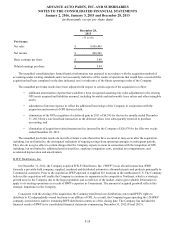

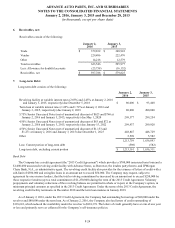

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-21

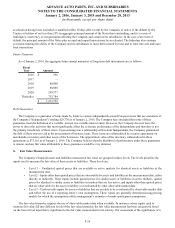

Under the terms of the agreement, the Company acquired the net assets in exchange for a purchase price of $187,109.

Following the closing of the acquisition, the Company sold certain of the acquired assets for $16,798 related to the transfer of

operations to GPI. The Company recognized $123,446 of goodwill upon the acquisition, which is expected to be deductible for

income tax purposes.

Other

The Company acquired 23 stores through multiple cash transactions during 2015. The aggregate cost of the store

acquisitions was $18,889, the value of which was primarily attributed to inventory, accounts receivable and goodwill. The fair

value of assets and liabilities assumed are included in the balance sheet as of January 2, 2016. Proforma financial information is

not provided based on materiality. The Company also acquired nine stores during 2014 with an aggregate purchase price of

$5,155. The results of these stores are not material to the Company's consolidated financial statements.

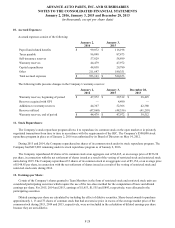

4. Exit Activities and Impairment:

Integration of Carquest stores

The Company approved plans in June 2014 to begin consolidating its Carquest stores acquired with GPI on January 2,

2014 as part of a multi-year integration plan. As of January 2, 2016, 178 Carquest stores had been consolidated into existing

Advance Auto Parts stores and 170 Carquest stores had been converted to the Advance Auto Parts format. This includes the

consolidation of 80 Carquest stores and conversion of 160 Carquest stores during 2015. Plans are in place to consolidate or

convert the remaining Carquest stores over the next few years. In addition, the Company continues to consolidate or convert the

remaining stores that were acquired with BWP on December 31, 2012 (which also operate under the Carquest trade name), 38

of which had been consolidated and 52 had been converted as of January 2, 2016. Four of these stores were consolidated and 20

stores were converted during 2015. As of January 2, 2016, the Company had 873 stores acquired with GPI and 12 stores

acquired with BWP still operating under the Carquest name. The Company incurred $7,286 and $7,888 of exit costs, primarily

consisting of closed facility lease obligations, related to the consolidations of Carquest stores during 2015 and 2014,

respectively.

Office Consolidations

In June 2014, the Company approved plans to relocate operations from its Minneapolis, Minnesota and Campbell,

California offices to other existing offices of the Company, including its offices in Newark, California, Roanoke, Virginia and

Raleigh, North Carolina, and to close its Minneapolis and Campbell offices. The Company also relocated various functions

between its existing offices in Roanoke and Raleigh. The relocations and office closings were substantially complete by the end

of 2015.

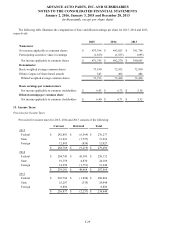

In connection with these relocations and office closings, the Company relocated some employees and terminated the

employment of others. The Company approved this action in order to take advantage of synergies following the acquisition of

GPI and to capitalize on the strength of existing locations and organizational experience. The Company incurred restructuring

costs of approximately $22,100 under these plans through the end of 2015. Substantially all of these costs were cash

expenditures. During 2015 and 2014, the Company recognized $3,869 and $6,731, respectively, of severance/outplacement

benefits under these restructuring plans and other severance related to the acquisition of GPI. During 2015 and 2014, the

Company recognized $4,419 and $7,053, respectively, of relocation costs.

Other Exit Activities

In the second half of 2015, the Company closed 80 underperforming Advance Auto Parts, Carquest and AI stores and

eliminated certain positions at its corporate offices. The majority of the corporate office eliminations were effective during

the third quarter of fiscal 2015. The Company recognized $6,909 related to the elimination of corporate office positions during

2015. The Company incurred restructuring costs of $21,984 related to the 80 store closures, primarily consisting of closed

facility lease obligations.