Advance Auto Parts 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-29

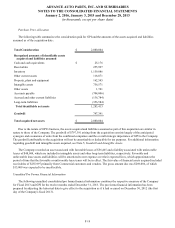

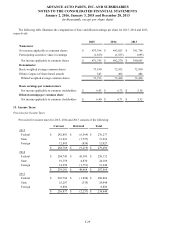

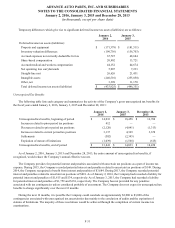

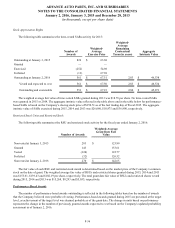

The following table illustrates the computation of basic and diluted earnings per share for 2015, 2014 and 2013,

respectively:

2015 2014 2013

Numerator

Net income applicable to common shares $ 473,398 $ 493,825 $ 391,758

Participating securities’ share in earnings (1,653)(1,555)(895)

Net income applicable to common shares $ 471,745 $ 492,270 $ 390,863

Denominator

Basic weighted average common shares 73,190 72,932 72,930

Dilutive impact of share-based awards 543 482 484

Diluted weighted average common shares 73,733 73,414 73,414

Basic earnings per common share

Net income applicable to common stockholders $ 6.45 $ 6.75 $ 5.36

Diluted earnings per common share

Net income applicable to common stockholders $ 6.40 $ 6.71 $ 5.32

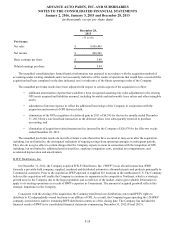

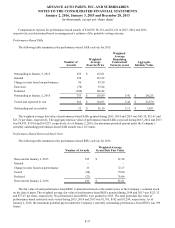

13. Income Taxes:

Provision for Income Taxes

Provision for income taxes for 2015, 2014 and 2013 consists of the following:

Current Deferred Total

2015

Federal $ 242,801 $ (6,564) $ 236,237

State 33,023 (1,797) 31,226

Foreign 12,885 (858) 12,027

$ 288,709 $ (9,219) $ 279,490

2014

Federal $ 204,743 $ 45,389 $ 250,132

State 19,359 4,830 24,189

Foreign 14,999 (1,751) 13,248

$ 239,101 $ 48,468 $ 287,569

2013

Federal $ 202,784 $ (1,898) $ 200,886

State 25,287 (339) 24,948

Foreign 8,806 — 8,806

$ 236,877 $ (2,237) $ 234,640