Advance Auto Parts 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-28

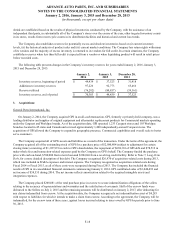

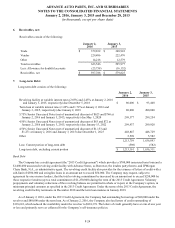

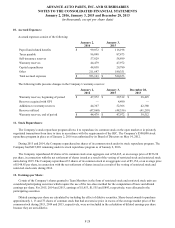

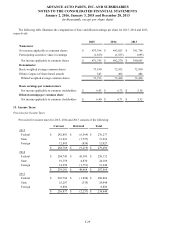

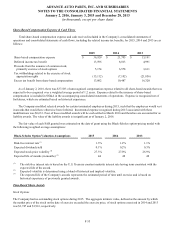

10. Accrued Expenses:

Accrued expenses consist of the following:

January 2,

2016

January 3,

2015

Payroll and related benefits $ 99,072 $ 116,198

Taxes payable 96,098 87,473

Self-insurance reserves 57,829 58,899

Warranty reserves 44,479 47,972

Capital expenditures 44,038 29,780

Other 211,647 180,351

Total accrued expenses $ 553,163 $ 520,673

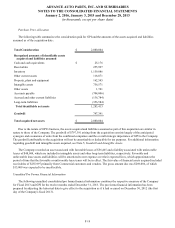

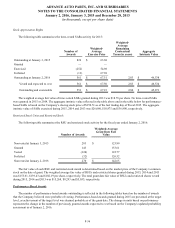

The following table presents changes in the Company’s warranty reserves:

January 2,

2016

January 3,

2015

December 28,

2013

Warranty reserves, beginning of period $ 47,972 $ 39,512 $ 38,425

Reserves acquired with GPI — 4,490 —

Additions to warranty reserves 44,367 52,306 42,380

Reserves utilized (47,860)(48,336)(41,293)

Warranty reserves, end of period $ 44,479 $ 47,972 $ 39,512

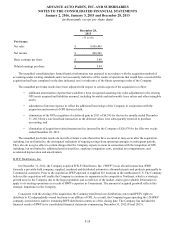

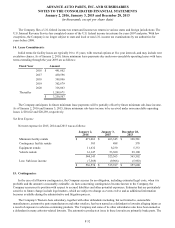

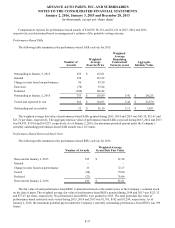

11. Stock Repurchases:

The Company’s stock repurchase program allows it to repurchase its common stock on the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the SEC. The Company’s $500,000 stock

repurchase program in place as of January 2, 2016 was authorized by its Board of Directors on May 14, 2012.

During 2015 and 2014, the Company repurchased no shares of its common stock under its stock repurchase program. The

Company had $415,092 remaining under its stock repurchase program as of January 2, 2016.

The Company repurchased 42 shares of its common stock at an aggregate cost of $6,665, or an average price of $156.98

per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock and restricted stock

units during 2015. The Company repurchased 35 shares of its common stock at an aggregate cost of $5,154, or an average price

of $148.85 per share, in connection with the net settlement of shares issued as a result of the vesting of restricted stock and

restricted stock units during 2014.

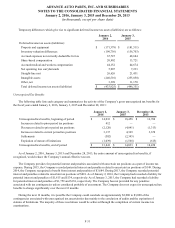

12. Earnings per Share:

Certain of the Company’s shares granted to Team Members in the form of restricted stock and restricted stock units are

considered participating securities which require the use of the two-class method for the computation of basic and diluted

earnings per share. For 2015, 2014 and 2013, earnings of $1,653, $1,555 and $895, respectively, were allocated to the

participating securities.

Diluted earnings per share are calculated by including the effect of dilutive securities. Share-based awards to purchase

approximately 1, 13 and 75 shares of common stock that had an exercise price in excess of the average market price of the

common stock during 2015, 2014 and 2013, respectively, were not included in the calculation of diluted earnings per share

because they are anti-dilutive.