Advance Auto Parts 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-18

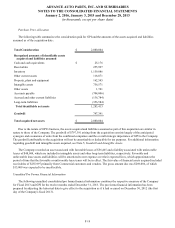

shrink are established based on the results of physical inventories conducted by the Company, with the assistance of an

independent third party, in substantially all of the Company’s stores over the course of the year, other targeted inventory counts

in its stores, results from recent cycle counts in its distribution facilities and historical and current loss trends.

The Company also establishes reserves for potentially excess and obsolete inventories based on (i) current inventory

levels, (ii) the historical analysis of product sales and (iii) current market conditions. The Company has return rights with many

of its vendors and the majority of excess inventory is returned to its vendors for full credit. In certain situations, the Company

establishes reserves when less than full credit is expected from a vendor or when liquidating product will result in retail prices

below recorded costs.

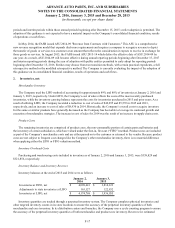

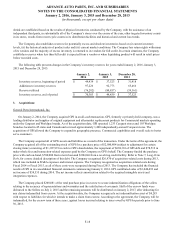

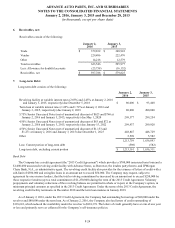

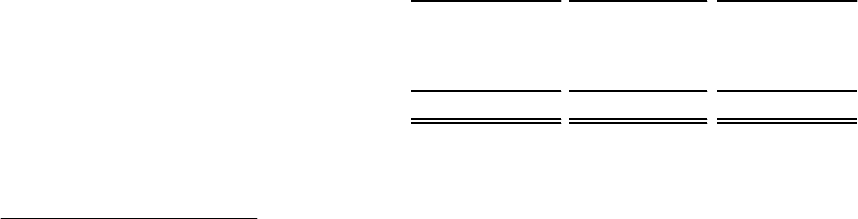

The following table presents changes in the Company’s inventory reserves for years ended January 2, 2016, January 3,

2015 and December 28, 2013:

January 2,

2016

January 3,

2015

December 28,

2013

Inventory reserves, beginning of period $ 49,439 $ 37,523 $ 31,418

Additions to inventory reserves 97,226 92,773 65,466

Reserves utilized (76,282)(80,857)(59,361)

Inventory reserves, end of period $ 70,383 $ 49,439 $ 37,523

3. Acquisitions:

General Parts International, Inc.

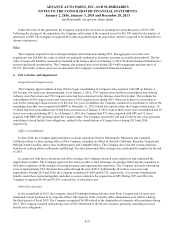

On January 2, 2014, the Company acquired GPI in an all-cash transaction. GPI, formerly a privately-held company, was a

leading distributor and supplier of original equipment and aftermarket replacement products for Commercial markets operating

under the Carquest and Worldpac brands. As of the acquisition date, GPI operated 1,233 Carquest stores and 103 Worldpac

branches located in 45 states and Canada and serviced approximately 1,400 independently-owned Carquest stores. The

acquisition of GPI allowed the Company to expand its geographic presence, Commercial capabilities and overall scale to better

serve customers.

The Company acquired all of GPI's assets and liabilities as a result of the transaction. Under the terms of the agreement, the

Company acquired all of the outstanding stock of GPI for a purchase price of $2,080,804 (subject to adjustment for certain

closing items) consisting of $1,307,991 in cash to GPI's shareholders, the repayment of $694,301 of GPI debt and $78,512 in

make-whole fees and transaction-related expenses paid by the Company on GPI's behalf. The Company funded the purchase

price with cash on-hand, $700,000 from a term loan and $306,046 from a revolving credit facility. Refer to Note 7, Long-Term

Debt, for a more detailed description of this debt. The Company recognized $26,970 of acquisition-related costs during 2013,

which was included in SG&A expenses and interest expense. The Company recognized no acquisition-related costs during

Fiscal 2014 or Fiscal 2015, as all of these costs were recognized during Fiscal 2013. The Company has included the financial

results of GPI in its consolidated financial statements commencing January 2, 2014. GPI contributed sales of $3,040,493 and

net income of $58,535 during 2014. The net income reflects amortization related to the acquired intangible assets and

integration expenses.

The Company placed $200,881 of the total purchase price in escrow to secure indemnification obligations of the sellers

relating to the accuracy of representations and warranties and the satisfaction of covenants. Half of the escrow funds were

disbursed to the Sellers on July 2, 2015 and the remaining amounts will be distributed on January 2, 2017, after deducting for

any claims indemnified from escrow. At the acquisition date, the Company recognized a net indemnification asset of $4,283

with respect to liabilities for which it intends to make a claim from escrow. According to the agreement, the Company will be

indemnified, for the escrow term of three years, against losses incurred relating to taxes owed by GPI for periods prior to June

30, 2013.