Advance Auto Parts 2015 Annual Report Download - page 70

Download and view the complete annual report

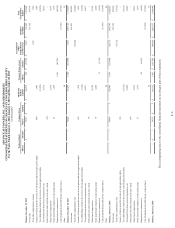

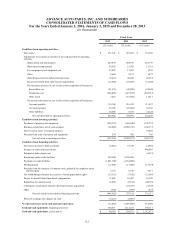

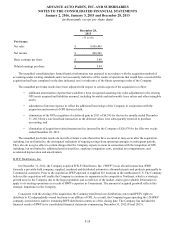

Please find page 70 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

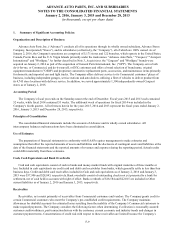

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-16

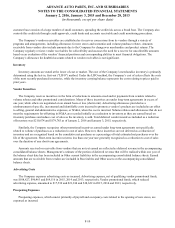

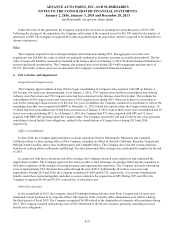

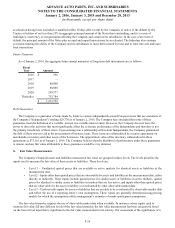

Recently Issued Accounting Pronouncements

In February 2016, the FASB issued ASU 2016-02, "Leases (Topic 842)." This ASU is a comprehensive new leases standard

that amends various aspects of existing guidance for leases and requires additional disclosures about leasing arrangements. It

will require companies to recognize lease assets and lease liabilities by lessees for those leases classified as operating leases

under previous GAAP. Topic 842 retains a distinction between finance leases and operating leases. The classification criteria

for distinguishing between finance leases and operating leases are substantially similar to the classification criteria for

distinguishing between capital leases and operating leases in the previous leases guidance. The ASU is effective for annual

periods beginning after December 15, 2018, including interim periods within those fiscal years; earlier adoption is permitted. In

the financial statements in which the ASU is first applied, leases shall be measured and recognized at the beginning of the

earliest comparative period presented with an adjustment to equity. Practical expedients are available for election as a package

and if applied consistently to all leases. The Company is currently evaluating the impact of the adoption of this guidance on its

consolidated financial condition, results of operations and cash flows.

In January 2016, the FASB issued ASU 2016-01 "Financial Instruments - Overall (Subtopic 825-10): Recognition and

Measurement of Financial Assets and Financial Liabilities." Although the ASU retains many of the current requirements for

financial instruments, it significantly revises an entity’s accounting related to (1) the classification and measurement of

investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair

value. It also amends certain disclosure requirements associated with the fair value of financial instruments. The ASU is

effective for annual periods and interim periods within those annual periods beginning after December 15, 2017; earlier

adoption is permitted. The adoption of this guidance is not expected to have a material impact on the Company's consolidated

financial condition, results of operations or cash flows.

In July 2015, the FASB issued ASU 2015-11 "Inventory (Topic 330): Simplifying the Measurement of Inventory." ASU

2015-11 requires entities to measure most inventory at the lower of cost or net recognizable value, simplifying the current

requirement that inventories be measured at the lower of cost or market. The ASU will not apply to inventories that are

measured using the last-in, first-out method or retail inventory method. The guidance will be effective prospectively for annual

periods, and interim periods within those annual periods, that begin after December 15, 2016; earlier adoption is permitted. As

the majority of the Company's inventory is accounted for under the last-in, first-out method, the adoption of this guidance is not

expected to have a material impact on the Company's consolidated financial condition, results of operations or cash flows.

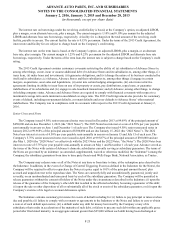

In April 2015, the FASB issued ASU 2015-3 "Interest - Imputation of Interest: Simplifying the Presentation of Debt

Issuance Costs." ASU 2015-3 simplifies the presentation of debt issuance costs by requiring such costs be presented as a

deduction from the corresponding debt liability. In August 2015, the FASB issued ASU 2015-15 "Interest - Imputed Interest

(Subtopic 835-30): Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit

Arrangements" which clarifies that entities may continue to defer and present debt issuance costs associated with a line-of-

credit as an asset and subsequently amortize the deferred costs ratably over the term of the arrangement. The guidance is

effective for financial statements issued for reporting periods beginning after December 15, 2015 and interim periods within the

reporting periods and requires retrospective presentation; earlier adoption is permitted. The adoption of this guidance is not

expected to have a material impact on the Company's consolidated financial condition, results of operations or cash flows.

In August 2014, the FASB, issued ASU 2014-15 “Presentation of Financial Statements - Going Concern (Subtopic

205-40): Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern." This new standard requires

management to perform interim and annual assessments of an entity's ability to continue as a going concern within one year of

the date the financial statements are issued. An entity must provide certain disclosures if conditions or events raise substantial

doubt about the entity's ability to continue as a going concern. This ASU is effective for annual periods ending after December

15, 2016, and interim periods thereafter; earlier adoption is permitted. The adoption of this guidance is not expected to have a

material impact on the Company's consolidated financial condition, results of operations or cash flows.

In June 2014, the FASB, issued ASU 2014-12 “Compensation - Stock Compensation (Topic 718): Accounting for Share-

Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite

Service Period." The amendments in this ASU require that a performance target that affects vesting and that could be achieved

after the requisite service period be treated as a performance condition. The amendments in this ASU are effective for annual