Advance Auto Parts 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

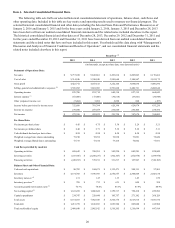

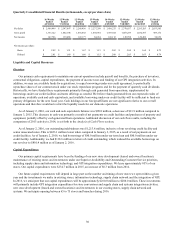

Gross Profit

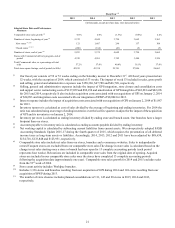

Gross profit for 2014 was $4,453.6 million, or 45.2% of net sales, as compared to $3,252.1 million, or 50.1% of net sales,

in 2013, a decrease of 484 basis points. The decrease in gross profit as a percentage of net sales was primarily due to the higher

mix of Commercial sales which has a lower gross margin rate resulting from the acquisition of GPI and increased supply chain

costs, partially offset by acquisition synergy savings.

SG&A Expenses

SG&A expenses for 2014 were $3,601.9 million, or 36.6% of net sales, as compared to $2,591.8 million, or 39.9% of net

sales, for 2013, a decrease of 332 basis points. The primary driver of the net decrease in SG&A expenses, as a percentage of net

sales, was the result of the acquired GPI business having a lower SG&A cost structure. Partially offsetting this decrease were

$73.2 million, or 74 basis points, of GPI integration expenses, $42.7 million, or 43 basis points, of amortization of acquired

GPI intangible assets and $9.0 million, or 9 basis points, of BWP integration expenses.

Operating Income

Operating income for 2014 was $851.7 million, representing 8.7% of net sales, as compared to $660.3 million, or 10.2% of

net sales, for 2013, a decrease of 152 basis points. This decrease was due to a lower gross profit rate partially offset by a lower

SG&A rate. These decreases on a rate basis were due to the gross profit and SG&A drivers previously discussed.

Interest Expense

Interest expense for 2014 was $73.4 million, or 0.7% of net sales, as compared to $36.6 million, or 0.6% of net sales, in

2013. The increase in interest expense was due to additional borrowings related to the GPI acquisition.

Income Taxes

Income tax expense for 2014 was $287.6 million, as compared to $234.6 million for 2013. Our effective income tax rate

was 36.8% and 37.5% for 2014 and 2013, respectively. Our income tax rate in 2014 was lower than the prior year primarily due

to certain non-deductible costs related to the GPI acquisition that increased the rate in 2013. Our income tax rates in both 2014

and 2013 reflect favorable income tax settlements and statute of limitation expirations.

Net Income

Net income was $493.8 million, or $6.71 per diluted share, for 2014 as compared to $391.8 million, or $5.32 per diluted

share, for 2013. As a percentage of net sales, net income for 2014 was 5.0%, as compared to 6.0% for 2013. The increase in

diluted EPS was driven primarily by the increase in net income.