Advance Auto Parts 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

Business Update

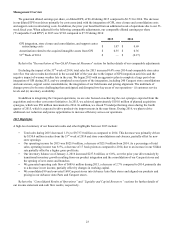

Our overarching focus in 2016 will be on becoming a field-centric organization while continuing to achieve our GPI

integration milestones with less overall disruption to our stores and customers. In addition, we have the following three

priorities which we believe are critical in the success of our field-centric organization and producing favorable financial results

over the long-term:

• Superior Availability is aimed at product availability and ensuring our stores have the right part at the right time

when a customer needs it. We will empower our store general managers to make more decisions and tailor their

inventories to best serve their unique local customer bases. We will continue to improve localized parts availability

through leveraging our HUB stores and expanded delivery frequency from our distribution centers.

• Outstanding Customer Service involves providing the proper infrastructure to achieve our operational goals through

flawless execution in meeting our Commercial customers' needs and goal of becoming a Commercial first business.

Sales to Commercial customers remain the largest opportunity for us to increase our overall market share in the

automotive aftermarket industry. Our Commercial sales, as a percentage of total sales, were 57% in both 2015 and

2014. We must meet the needs of our customers at a local level by providing the appropriate incentives and training to

develop focused and inspired teams that are empowered to make decisions in their local markets. We will continue to

educate our field teams and customers about the high quality parts and brands we offer and emphasize our customer

retention membership programs, including TECH-NET, ProRewards and SpeedPerks. We believe that by focusing on

Commercial customers, we will naturally build the availability and customer service that will also benefit our DIY

customers.

• Focused and Inspired Team is a team that is dedicated to generating sales in a more simplified environment, has the

empowerment to execute the two priorities above and drives improvements across the entire company to deliver

profitable growth.

Our multi-year GPI integration plan remains underway which is focused on the integration of our Advance Auto Parts and

Carquest operations. During 2015, we completed the support center consolidations that were initiated in 2014, integrated our

field teams, harmonized pricing and brands and substantially completed product changeovers. In addition, we completed the

first major wave of the Carquest store consolidations and conversions that we began in the second half of 2014. During 2016,

we will continue executing our integration plans by consolidating or converting an estimated additional 325 to 350 Carquest

stores. In addition, we will shift our focus to the deployment of systems necessary to align critical capabilities within supply

chain and information technology.

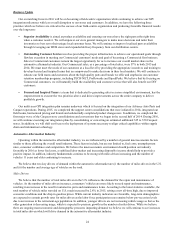

Automotive Aftermarket Industry

Operating within the automotive aftermarket industry, we are influenced by a number of general macroeconomic factors

similar to those affecting the overall retail industry. These factors include, but are not limited to, fuel costs, unemployment

rates, consumer confidence and competition. We believe the macroeconomic environment should position our industry

favorably in 2016 as lower fuel costs, a stabilized labor market and increasing disposable income should help to provide a

positive impact. In addition, industry fundamentals continue to be strong with miles driven increasing and the number of

vehicles 11 years and older continuing to increase.

We believe that two key drivers of demand within the automotive aftermarket are (i) the number of miles driven in the U.S.

and (ii) the number and average age of vehicles on the road.

Miles Driven

We believe that the number of total miles driven in the U.S. influences the demand for the repair and maintenance of

vehicles. As the number of miles driven increases, consumers’ vehicles are more likely to need repair and maintenance,

resulting in an increase in the need for automotive parts and maintenance items. According to the latest statistics available, the

total number of vehicle miles traveled on U.S. roads increased by 2.8% in 2015, setting a new all-time high, due to improved

economic conditions and the drop in gasoline prices. While current industry indicators are favorable, long-term demographics

are expected to contain growth rates for miles driven as the labor force participation rate remains below pre-recession levels

due to an increase in the retirement-age population. In addition, younger drivers are not increasing vehicle usage as fast as the

older generation is decreasing usage, which is expected to pressure growth in the number of miles driven. While we believe

there are ongoing macroeconomic and demographic pressures impacting demand, we believe we will continue to see increases

in total miles driven which will drive demand in the automotive aftermarket industry.