Advance Auto Parts 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

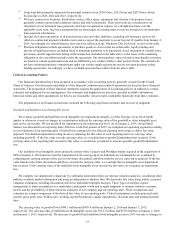

Foreign Currency Exchange Rate Risk

Our primary foreign currency exposure arises from our Canadian operations and the translation of Canadian dollar

denominated revenues, profits and net assets into U.S. dollars. During 2015, the translation of the operating results of our

Canadian subsidiaries did not significantly impact net income. We view our investments in the Canadian subsidiaries as long-

term, and any changes in our net assets in the Canadian subsidiaries relating to foreign currency exchange rates would be

reflected in the foreign currency translation component of Accumulated other comprehensive loss, unless the Canadian

subsidiaries are sold or otherwise disposed.

In addition, we are exposed to foreign currency exchange rate fluctuations for a portion of the Company's inventory

purchases which are denominated in foreign currencies and for intercompany balances. We believe that the price volatility of

these inventory purchases as it relates to foreign currency exchange rates is partially mitigated by our ability to adjust selling

prices. Losses from foreign currency transactions, which are included in Other income, net, were $7.4 million during 2015.

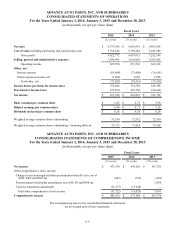

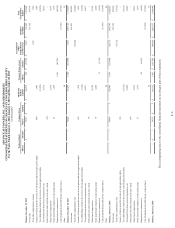

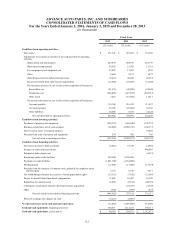

Item 8. Financial Statements and Supplementary Data.

See financial statements included in Item 15 “Exhibits, Financial Statement Schedules” of this annual report.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Disclosure Controls and Procedures

Disclosure controls and procedures are our controls and other procedures that are designed to ensure that information

required to be disclosed by us in our reports that we file or submit under the Securities Exchange Act of 1934 is recorded,

processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and

procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by

us in our reports that we file or submit under the Securities Exchange Act of 1934 is accumulated and communicated to our

management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions

regarding required disclosure. Our management evaluated, with the participation of our principal executive officer and

principal financial officer, the effectiveness of our disclosure controls and procedures as of January 2, 2016 in accordance with

Rule 13a-15(b) under the Exchange Act. Based on this evaluation, our principal executive officer and our principal financial

officer have concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were

effective.

Management’ s Report on Internal Control over Financial Reporting

Management’s Report on Internal Control over Financial Reporting is set forth in Part IV, Item 15 of this annual report.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the quarter ended January 2,

2016 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Item 9B. Other Information.

None.