Advance Auto Parts 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

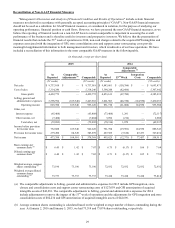

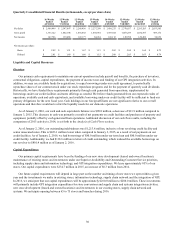

(1) Long-term debt primarily represents the principal amount of our 2020 Notes, 2022 Notes and 2023 Notes, which

become due in 2020, 2022 and 2023, respectively.

(2) We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property leases

generally contain renewal and escalation clauses and other concessions. These provisions are considered in our

calculation of our minimum lease payments which are recognized as expense on a straight-line basis over the

applicable lease term. Any lease payments that are based upon an existing index or rate are included in our minimum

lease payment calculations.

(3) Includes the long-term portion of deferred income taxes and other liabilities, including self-insurance reserves for

which no contractual payment schedule exists and we expect the payments to occur beyond 12 months from January 2,

2016. Accordingly, the related balances have not been reflected in the “Payments Due by Period” section of the table.

(4) Purchase obligations include agreements to purchase goods or services that are enforceable, legally binding and

specify all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Included in the table above is the lesser of the remaining

obligation or the cancellation penalty under the agreement. Our open purchase orders related to merchandise inventory

are based on current operational needs and are fulfilled by our vendors within a short period of time. We currently do

not have minimum purchase commitments under our vendor supply agreements nor are our open purchase orders

binding agreements. Accordingly, we have excluded open purchase orders from the above table.

Critical Accounting Policies

Our financial statements have been prepared in accordance with accounting policies generally accepted in the United

States of America. Our discussion and analysis of the financial condition and results of operations are based on these financial

statements. The preparation of these financial statements requires the application of accounting policies in addition to certain

estimates and judgments by our management. Our estimates and judgments are based on currently available information,

historical results and other assumptions we believe are reasonable. Actual results could differ materially from these estimates.

The preparation of our financial statements included the following significant estimates and exercise of judgment.

Goodwill and Indefinite-Lived Intangible Assets

We evaluate goodwill and indefinite-lived intangibles for impairment annually as of the first day of our fiscal fourth

quarter or whenever events or changes in circumstances indicate the carrying value of the goodwill or other intangible asset

may not be recoverable. We test goodwill for impairment at the reporting unit level. As of January 2, 2016, our goodwill

balance was allocated to six reporting units. Effective in the first quarter of 2015, we realigned our operating segments resulting

in a reevaluation of our reporting units. Goodwill was reassigned to the affected reporting units using a relative fair value

approach. Our detailed impairment testing involves comparing the fair value of each reporting unit to its carrying value,

including goodwill. If the fair value exceeds carrying value, we conclude that no goodwill impairment has occurred. If the

carrying value of the reporting unit exceeds its fair value, a second step is required to measure possible goodwill impairment

loss.

Our indefinite-lived intangible assets primarily consist of the Carquest and Worldpac brands acquired in the acquisition of

GPI on January 2, 2014 and are tested for impairment at the asset group level. Indefinite-lived intangibles are evaluated by

comparing the carrying amount of the asset to the future discounted cash flows that the asset is expected to generate. If the fair

value based on the future discounted cash flows exceeds the carrying value, we conclude that no intangible asset impairment

has occurred. If the carrying value of the indefinite-lived intangible asset exceeds the fair value, we recognize an impairment

loss.

We complete our impairment evaluations by combining information from our internal valuation analyses, considering other

publicly available market information and using an independent valuation firm. We determine fair value using widely accepted

valuation techniques, including discounted cash flows and market multiple analyses. These types of analyses require

management to make assumptions as a marketplace participant would and to apply judgment to estimate industry economic

factors and the profitability of future business strategies of our company and our reporting units. These assumptions and

estimates are a major component of the derived fair value of our reporting units. Critical assumptions include projected sales

growth, gross profit rates, SG&A rates, working capital fluctuations, capital expenditures, discount rates and terminal growth

rates.

The carrying value of goodwill was $989.5 million and $995.4 million at January 2, 2016 and January 3, 2015,

respectively. The carrying value of indefinite-lived intangible assets was $334.7 million and $339.4 million at January 2, 2016

and January 3, 2015, respectively. The decrease to goodwill and indefinite-lived intangible assets in 2015 was due to changes in