Advance Auto Parts 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

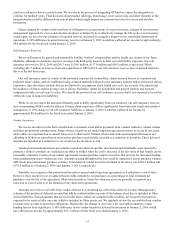

F-6

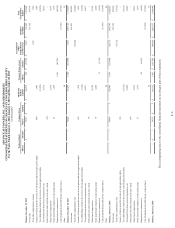

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

CONSOLIDATD STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

For the Years Ended January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands)

Preferred Stock Common Stock Additional

Paid-in

Capital

Treasury Stock, at cost

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Total

Stockholders'

Equity

Shares Amount Shares Amount Shares Amount

Balance, December 29, 2012 — $ — 73,731 $ 7 $ 520,215 348 $ (27,095) $ 2,667 $ 714,900 $ 1,210,694

Net income 391,758 391,758

Total other comprehensive income 1,016 1,016

Issuance of shares upon the exercise of stock options and stock appreciation rights 480 1,903 1,903

Tax withholdings related to the exercise of stock appreciation rights (21,856)(21,856)

Tax benefit from share-based compensation, net 16,132 16,132

Restricted stock and restricted stock units vested (10) —

Share-based compensation 13,191 13,191

Stock issued under employee stock purchase plan 23 1,679 1,679

Repurchase of common stock 1,036 (80,795) (80,795)

Cash dividends declared ($0.24 per common share) (17,546) (17,546)

Other 29 29

Balance, December 28, 2013 — — 74,224 7 531,293 1,384 (107,890) 3,683 1,089,112 1,516,205

Net income 493,825 493,825

Total other comprehensive loss (16,020) (16,020)

Issuance of shares upon the exercise of stock options and stock appreciation rights 162 1,874 1,874

Tax withholdings related to the exercise of stock appreciation rights (7,102)(7,102)

Tax benefit from share-based compensation, net 10,471 10,471

Restricted stock and restricted stock units vested 68 —

Share-based compensation 21,705 21,705

Stock issued under employee stock purchase plan 39 4,660 4,660

Repurchase of common stock 35 (5,154) (5,154)

Cash dividends declared ($0.24 per common share) (17,596) (17,596)

Other 44 44

Balance, January 3, 2015 — — 74,493 7 562,945 1,419 (113,044) (12,337) 1,565,341 2,002,912

Net income 473,398 473,398

Total other comprehensive loss (31,722) (31,722)

Issuance of shares upon the exercise of stock appreciation rights 138 —

Tax withholdings related to the exercise of stock appreciation rights (13,112)(13,112)

Tax benefit from share-based compensation, net 12,989 12,989

Restricted stock and restricted stock units vested 109 —

Share-based compensation 35,336 35,336

Stock issued under employee stock purchase plan 35 5,139 5,139

Repurchase of common stock 42 (6,665) (6,665)

Cash dividends declared ($0.24 per common share) (17,662) (17,662)

Other 35 35

Balance, January 2, 2016 — $ — 74,775 $ 7 $ 603,332 1,461 $ (119,709) $ (44,059) $ 2,021,077 $ 2,460,648

The accompanying notes to the consolidated financial statements are an integral part of these statements.