Advance Auto Parts 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 2, 2016, January 3, 2015 and December 28, 2013

(in thousands, except per share data)

F-11

Income Taxes

The Company accounts for income taxes under the asset and liability method which requires the recognition of deferred

tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements.

Under the asset and liability method, deferred tax assets and liabilities are determined based on the differences between the

financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences

are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the

period of the enactment date.

The Company recognizes tax benefits and/or tax liabilities for uncertain income tax positions based on a two-step process.

The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is

more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes,

if any. The second step requires the Company to estimate and measure the tax benefit as the largest amount that is more than

50% likely to be realized upon ultimate settlement. It is inherently difficult and subjective to estimate such amounts, as the

Company must determine the probability of various possible outcomes.

The Company reevaluates these uncertain tax positions on a quarterly basis or when new information becomes available to

management. The reevaluations are based on many factors, including but not limited to, changes in facts or circumstances,

changes in tax law, successfully settled issues under audit, expirations due to statutes of limitations and new federal or state

audit activity. Any change in either the Company’s recognition or measurement could result in the recognition of a tax benefit

or an increase to the tax accrual.

The Company also follows guidance provided on other items relevant to the accounting for income taxes throughout the

year, as applicable, including derecognition of benefits, classification, interest and penalties, accounting in interim periods,

disclosure and transition. The Company retrospectively adopted Accounting Standards Update, or ASU, 2015-17 "Income

Taxes - Balance Sheet Classification of Deferred Taxes (Topic 740)" during the fourth quarter of 2015, which requires the

presentation of all deferred taxes as long-term assets or liabilities. Refer to Note 13, Income Taxes, for a further discussion of

income taxes.

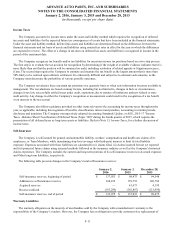

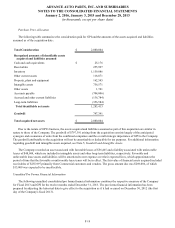

Self-Insurance

The Company is self-insured for general and automobile liability, workers’ compensation and health care claims of its

employees, or Team Members, while maintaining stop-loss coverage with third-party insurers to limit its total liability

exposure. Expenses associated with these liabilities are calculated for (i) claims filed, (ii) claims incurred but not yet reported

and (iii) projected future claims using actuarial methods followed in the insurance industry as well as the Company’s historical

claims experience. The Company includes the current and long-term portions of its self-insurance reserves in Accrued expenses

and Other long-term liabilities, respectively.

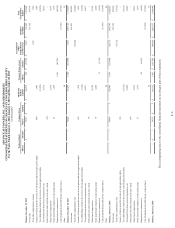

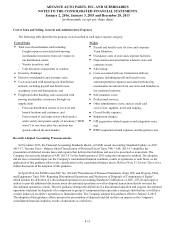

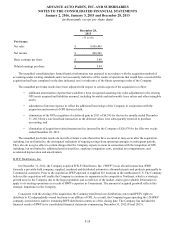

The following table presents changes in the Company’s total self-insurance reserves:

January 2,

2016

January 3,

2015

December 28,

2013

Self-insurance reserves, beginning of period $ 137,033 $ 98,475 $ 94,548

Additions to self-insurance reserves 160,232 159,752 120,782

Acquired reserves — 41,673 4,195

Reserves utilized (163,290)(162,867)(121,050)

Self-insurance reserves, end of period $ 133,975 $ 137,033 $ 98,475

Warranty Liabilities

The warranty obligation on the majority of merchandise sold by the Company with a manufacturer's warranty is the

responsibility of the Company’s vendors. However, the Company has an obligation to provide customers free replacement of