Advance Auto Parts 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

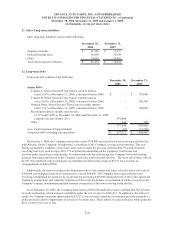

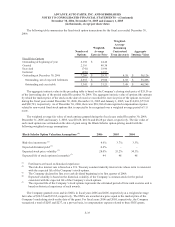

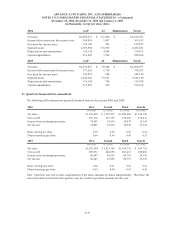

The following table summarizes the fixed stock option transactions for the fiscal year ended December 30,

2006:

Number of

Options

Weighted-

Average

Exercise Price

Weighted-

Average

Remaining

Contractual

Term (in years)

Aggregate

Intrinsic Value

Fixed Price Options

Outstanding at beginning of year 6,192 24.46$

Granted 2,116 40.38

Exercised (741) 18.96

Forfeited (298) 32.97

Outstanding at December 30, 2006 7,269 29.31$ 4.58 56,126$

Outstanding, net of expected forfeitures 6,955 29.00$ 4.58 55,496$

Outstanding and exercisable 3,341 21.21$ 3.49 48,249$

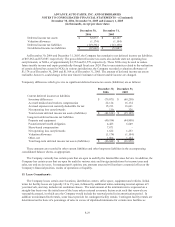

The aggregate intrinsic value in the preceding table is based on the Company’s closing stock price of $35.56 as

of the last trading day of the period ended December 30, 2006. The aggregate intrinsic value of options (the amount

by which the market price of the stock on the date of exercise exceeded the exercise price of the option) exercised

during the fiscal years ended December 30, 2006, December 31, 2005 and January 1, 2005, was $14,001, $77,611

and $60,793, respectively. As of December 30, 2006, there was $26,304 of unrecognized compensation expense

related to non-vested fixed stock options that is expected to be recognized over a weighted average period of 1.8

years.

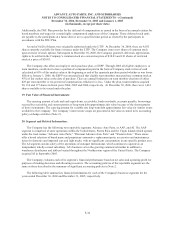

The weighted average fair value of stock options granted during the fiscal years ended December 30, 2006,

December 31, 2005 and January 1, 2005, was $10.68, $10.54 and $8.28 per share, respectively. The fair value of

each stock option was estimated on the date of grant using the Black-Scholes option-pricing model with the

following weighted average assumptions:

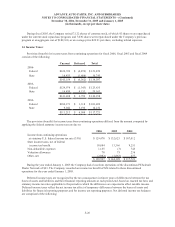

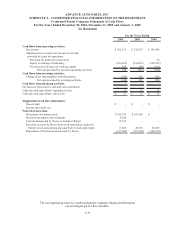

Black-Scholes Option Valuation Assumptions

(1)

2006 2005 2004

Risk-free interest rate

(2)

4.6% 3.7% 3.3%

Expected dividend yield

(3)

0.6% - -

Expected stock price volatility

(4)

28.0% 33.2% 34.3%

Expected life of stock options (in months)

(5)

44 48 48

(1) Forfeitures are based on historical experience.

(2) The risk-free interest rate is based on a U.S. Treasury constant maturity interest rate whose term is consistent

with the expected life of the Company’s stock options.

(3) The Company declared its first ever cash dividend beginning in its first quarter of 2006.

(4) Expected volatility is based on the historical volatility of the Company’s common stock for the period

consistent with the expected life of the Company’s stock options.

(5) The expected life of the Company’s stock options represents the estimated period of time until exercise and is

based on historical experience of such awards.

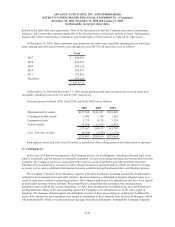

The Company granted seven and six DSUs in fiscal years 2006 and 2005, respectively at a weighted average

fair value of $38.35 and $39.65, respectively. The DSUs are awarded at a price equal to the market price of the

Company’s underlying stock on the date of the grant. For fiscal years 2006 and 2005, respectively, the Company

recognized a total of $285 and $237, on a pre-tax basis, in compensation expense related to these DSU grants.

F-33