Advance Auto Parts 2006 Annual Report Download - page 52

Download and view the complete annual report

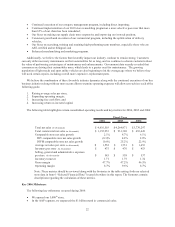

Please find page 52 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, general and administrative expenses were $1,797.8 million, or 39.0% of net sales, for 2006, as

compared to $1,606.0 million, or 37.6% of net sales, for 2005. Selling, general and administrative expenses

increased as a percentage of sales as a result of:

xrecording share-based compensation expense of approximately 0.4% of net sales upon the implementation of

SFAS 123R on January 1, 2006;

xa 0.5% increase in certain fixed costs as a percentage of sales during the year, including rent and depreciation,

as a result of low comparative sales growth; and

xa 0.3% increase in expenses associated with higher costs for insurance programs, including workers’

compensation, auto liability and general liability.

Additionally, AI contributed approximately 0.2% of selling, general and administrative expenses as a result of

the reinvestment of working capital to accelerate their new store growth.

Interest expense for 2006 was $36.0 million, or 0.8% of net sales, as compared to $32.4 million, or 0.7% of net

sales, in 2005. The increase in interest expense is a result of both higher average outstanding debt levels and

borrowing rates as compared to fiscal 2005. In addition, other income for fiscal 2006 decreased as a result of less

interest income associated with lower cash balances throughout the year.

Income tax expense for 2006 was $138.6 million, as compared to $144.2 million for 2005. Our effective

income tax rate was 37.5% and 38.1% for 2006 and 2005, respectively.

We generated net income of $231.3 million, or $2.16 per diluted share, for 2006, as compared to $234.7

million, or $2.13 per diluted share, for 2005. As a percentage of sales, net income for 2006 was 5.0%, as compared

to 5.5% for 2005. Our earnings per diluted share results reflect the impact on both earnings and the diluted share

count of implementing FAS 123R as further explained in this management’s discussion and analysis and in the notes

to our financial statements contained elsewhere in this Form 10-K.

Fiscal 2005 Compared to Fiscal 2004

Net sales for 2005 were $4,265.0 million, an increase of $494.7 million, or 13.1%, over net sales for 2004. The

net sales increase was due to an increase in comparable store sales of 8.7%, contributions from the 151 new stores

opened within the last year and sales from acquired operations. The comparable store sales increase was driven by

an increase in average ticket sales and a slight increase in customer traffic.

Gross profit for 2005 was $2,014.5 million, or 47.2% of net sales, as compared to $1,753.4 million, or 46.5% of

net sales, in 2004. The increase in gross profit as a percentage of sales reflects continued benefits realized from our

category management program in the form of better margins on key product categories and increased incentives

under our vendor programs and supply chain efficiencies.

Selling, general and administrative expenses were $1,606.0 million, or 37.6% of net sales, for 2005, as

compared to $1,424.6 million, or 37.8% of net sales, for 2004. For fiscal 2005, we experienced a decrease in selling,

general and administrative expenses as a percentage of net sales resulting from our ability to leverage our strong

comparable store sales and lower self-insurance expense partially offset by higher fuel and energy costs.

Interest expense for 2005 was $32.4 million, or 0.7% of net sales, as compared to $20.1 million, or 0.5% of net

sales, in 2004. The increase in interest expense is a result of both higher average outstanding debt levels and

borrowing rates as compared to fiscal 2004.

Income tax expense for 2005 was $144.2 million, as compared to $117.7 million for 2004. This increase in

income tax expense primarily reflects our higher earnings. Our effective income tax rate was 38.1% and 38.5% for

2005 and 2004, respectively.

We generated net income of $234.7 million, or $2.13 per diluted share, for 2005, as compared to $188.0

million, or $1.66 per diluted share, for 2004. As a percentage of sales, net income for 2005 was 5.5%, as compared

to 5.0% for 2004.

29