Advance Auto Parts 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

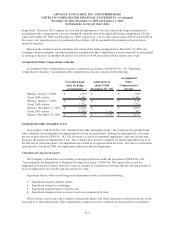

Company did recognize an insignificant amount of share-based compensation expense related to the grant of

deferred stock units to its Board of Directors.

On January 1, 2006, the Company adopted the provisions of SFAS No. 123 (revised 2004), "Share-Based

Payment," or SFAS No. 123R. SFAS No. 123R replaces SFAS No. 123 and supersedes APB Opinion No. 25 and

subsequently issued stock option related guidance. The Company elected to use the modified-prospective method of

implementation. Under this transition method, share-based compensation expense for the fiscal year ended

December 30, 2006 included compensation expense for all share-based awards granted subsequent to January 1,

2006 based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123R, and

compensation expense for all share-based awards granted prior to but unvested as of January 1, 2006 based on the

grant-date fair value estimated in accordance with original provisions of SFAS No. 123.

The Company uses the Black-Scholes option-pricing model to value all options and the straight-line method to

amortize this fair value as compensation cost over the requisite service period. Total share-based compensation

expense included in selling, general and administrative expenses in the accompanying consolidated statements of

operations for the fiscal year ended December 30, 2006 was $19,052. The related income tax benefit was $7,145.

The Company recognized $363 and $494 of share-based compensation expense in accordance with APB No. 25 for

the fiscal years ended December 31, 2005 and January 1, 2005, respectively. In accordance with the modified-

prospective transition method of SFAS No. 123R, the Company has not restated prior periods.

As a result of adopting SFAS No. 123R on January 1, 2006, the Company’s earnings before income tax expense

and net earnings for the fiscal year ended December 30, 2006, were $18,767 and $11,730 lower, respectively, than if

the Company had continued to account for share-based compensation under APB No. 25. The related impact in 2006

to basic and diluted earnings per share is $0.11 for the fiscal year ended December 30, 2006.

In November 2005, the FASB issued FASB Staff Position No. FAS 123R-3 “Transition Election Related to

Accounting for Tax Effects of Share-Based Payment Awards.” We elected to adopt the alternative transition method

provided in the FASB Staff Position for calculating the tax effects of stock-based compensation. The alternative

transition method includes simplified methods to determine the beginning balance of the additional paid-in capital

(APIC) pool related to the tax effects of stock-based compensation, and to determine the subsequent impact on the

APIC pool and the statement of cash flow of the tax effects of stock-based awards that were fully vested and

outstanding upon the adoption of SFAS No. 123R.

Prior to the adoption of SFAS No.123R, the Company reported the benefit of tax deductions in excess of

recognized stock compensation expense, or excess tax benefits, resulting from the exercise of stock options as

operating cash inflows in its consolidated statements of cash flows. In accordance with SFAS No.123R, the

Company revised its statement of cash flows presentation prospectively to include these excess tax benefits from the

exercise of stock options as financing cash inflows rather than operating cash inflows. Accordingly, for the fiscal

year ended December 30, 2006, the Company reported $5,272 of excess tax benefits as a financing cash inflow.

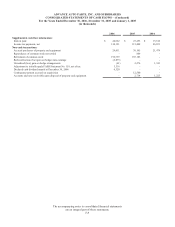

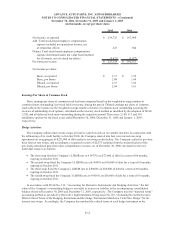

The following table reflects the impact on net income and earnings per share as if the Company had applied the

fair value based method of recognizing share-based compensation costs as prescribed by SFAS No. 123 for the

fiscal years ended December 31, 2005 and January 1, 2005, respectively.

F-13