Advance Auto Parts 2006 Annual Report Download - page 47

Download and view the complete annual report

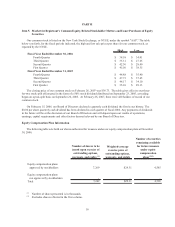

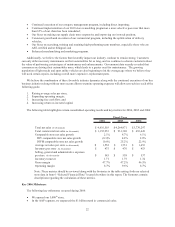

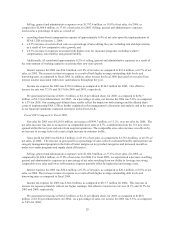

Please find page 47 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for fiscal year ended 2006 included compensation expense for all share-based awards granted subsequent to January

1, 2006 based on the grant-date fair value estimated in accordance with the provisions of SFAS No. 123R, and

compensation expense for all share-based awards granted prior to but unvested as of January 1, 2006 based on the

grant-date fair value estimated in accordance with original provisions of SFAS No. 123.

We use the Black-Scholes option-pricing model to value all options and straight-line method to amortize this

fair value as compensation cost over the requisite service period. Total share-based compensation expense included

in selling, general and administrative expenses in our statements of operations for the fiscal years ended 2006 was

$19.1 million. The related income tax benefit was $7.1 million. We recognized $0.4 and $0.5 million of share-based

compensation expense in accordance with APB No. 25 for the fiscal years ended December 31, 2005 and January 1,

2005. On a pro forma basis, share-based compensation was $0.09 and $0.05 per diluted share for the fiscal years

ended December 31, 2005 and January 1, 2005, respectively. In accordance with the modified-prospective transition

method of SFAS No. 123R, we have not restated prior periods.

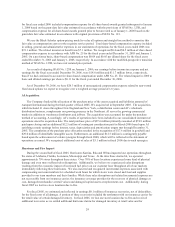

As a result of adopting SFAS No. 123R on January 1, 2006, our earnings before income tax expense and net

earnings for the fiscal year ended December 30, 2006, were $18.8 million and $11.7 million lower, respectively,

than if we had continued to account for share-based compensation under APB No. 25. The related impact in 2006 to

basic and diluted earnings per share is $0.11 for the fiscal year ended December 30, 2006.

As of December 30, 2006, we have $26.3 million of unrecognized compensation expense related to non-vested

fixed stock options we expect to recognize over a weighted average period of 1.8 years.

AI Acquisition

The Company finalized the allocation of the purchase price of the assets acquired and liabilities assumed of

Autopart International during the third quarter of fiscal 2006. We acquired AI in September 2005. The acquisition,

which included 61 stores throughout New England and New York, a distribution center and AI’s wholesale

distribution business, complements our growing presence in the Northeast. AI serves the growing commercial

market in addition to warehouse distributors and jobbers. The acquisition was accounted for under the purchase

method of accounting. Accordingly, AI’s results of operations have been included in our consolidated statement of

operations since the acquisition date. The total purchase price of $87.6 million primarily consisted of $74.9 million

paid upon closing and an additional $12.5 million of contingent consideration paid in March 2006 based upon AI

satisfying certain earnings before interest, taxes, depreciation and amortization targets met through December 31,

2005. The completion of the purchase price allocation resulted in the recognition of $17.6 million in goodwill and

$29.0 million of identifiable intangible assets. Furthermore, an additional $12.5 million is contingently payable

based upon the achievement of certain synergies through fiscal 2008, which will be reflected in the statement of

operations as earned. We recognized additional cost of sales of $3.1 million in fiscal 2006 due to such synergies.

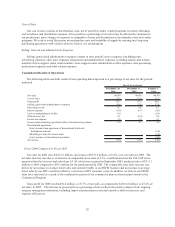

Hurricane and Fire Impact

During the second half of fiscal 2005, Hurricanes Katrina, Rita and Wilma impacted our operations throughout

the states of Alabama, Florida, Louisiana, Mississippi and Texas. At the time these storms hit, we operated

approximately 750 stores throughout these states. Over 70% of these locations experienced some kind of physical

damage and even more suffered sales disruptions. Additionally, we believe we experienced sales disruptions

resulting from the economic impact of increased fuel prices on our customer base throughout all of our markets

immediately following these hurricanes. We also incurred and recognized incremental expenses associated with

compensating our team members for scheduled work hours for which stores were closed and food and supplies

provided to our team members and their families. While these sales disruptions and related incremental expenses are

not recoverable from our insurance carrier, the insurance coverage provides for the recovery of physical damage at

cost, damaged merchandise at retail values and damaged capital assets at replacement cost. Additionally, during

fiscal 2005 we lost two store locations due to fire.

For fiscal 2005, we estimated and reflected in earnings $0.1 million of insurance recoveries, net of deductibles,

for the fixed costs of all damage. A portion of these recoveries included the settlement with our insurance carrier for

the retail value of certain damaged inventory. In fiscal 2006, we lost one store location due to fire and received

additional recoveries as we settled additional hurricane claims for damaged inventory at retail value and for

24