Advance Auto Parts 2006 Annual Report Download - page 80

Download and view the complete annual report

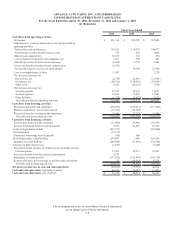

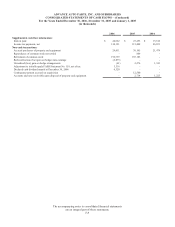

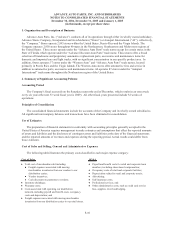

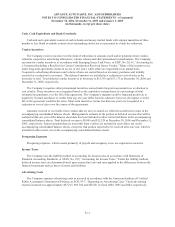

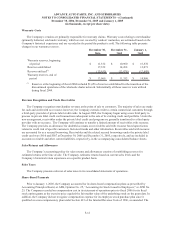

Please find page 80 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

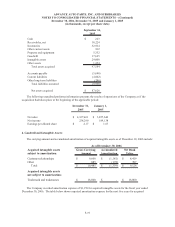

(in thousands, except per share data)

accompanying consolidated balance sheets.

New Accounting Pronouncements

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items

at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is

currently evaluating the impact of SFAS No. 159.

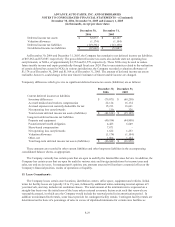

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment of FASB Statements No. 87, 88, 106, and 132(R).” SFAS No. 158

requires recognition of the overfunded or underfunded status of defined benefit postretirement plans as an asset or

liability in the statement of financial position and to recognize changes in that funded status in comprehensive

income in the year in which the changes occur. SFAS No. 158 also requires measurement of the funded status of a

plan as of the date of the statement of financial position. The Company adopted the recognition provisions of SFAS

No. 158 on December 30, 2006 and recorded a reduction to the liability of $5,357 and increase to other

comprehensive income of $3,316, net of tax (see Note 17). SFAS No. 158 is effective for the measurement date

provisions for fiscal years ending after December 15, 2008. The Company is currently evaluating the impact of

adopting the measurement provisions of SFAS No. 158.

In September 2006, the Securities and Exchange Commission, or SEC, staff issued Staff Accounting Bulletin

No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year

Financial Statements,” or SAB 108. SAB 108 was issued in order to eliminate the diversity in practice surrounding

how public companies quantify financial statement misstatements. SAB 108 requires that registrants quantify errors

using both a balance sheet and income statement approach and evaluate whether either approach results in a

misstated amount that, when all relevant quantitative and qualitative factors are considered, is material. SAB 108 is

effective for financial statements covering the first fiscal year ending after November 15, 2006. The Company

adopted SAB 108 for the year ended December 30, 2006 with no impact on its consolidated financial condition,

results of operations or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 clarifies the

definition of fair value, establishes a framework for measuring fair value, and expands the disclosures on fair value

measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is

currently evaluating the impact of SFAS No. 157.

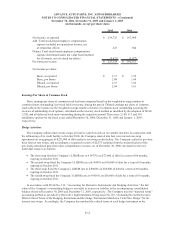

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,” or

FIN 48. FIN 48 clarifies the accounting and reporting for income taxes recognized in accordance with SFAS No.

109, “Accounting for Income Taxes.” The interpretation prescribes a recognition threshold and measurement

attribute for the financial statement recognition, measurement, presentation and disclosure of uncertain tax positions

taken or expected to be taken in income tax returns. FIN 48 is effective for fiscal years beginning after

December 15, 2006. The Company will adopt the provisions of FIN 48 as of December 31, 2006. Accordingly, the

Company estimates a cumulative effect adjustment will be recorded to reduce its retained earnings by an amount

less than $8,000 upon initial adoption.

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets – an

amendment of FASB Statement No. 140.” SFAS No. 156 amends SFAS No. 140, “Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of Liabilities,” with respect to the accounting for separately

recognized servicing assets and servicing liabilities. SFAS No. 156 is effective for fiscal years beginning after

September 15, 2006. The Company does not expect the adoption of SFAS No. 156 to have a material impact on its

financial condition, results of operations or cash flows.

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments - an

amendment of FASB Statements No. 133 and 140.” This statement simplifies accounting for certain hybrid

instruments currently governed by SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,”

F-17