Advance Auto Parts 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

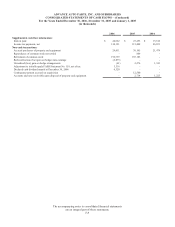

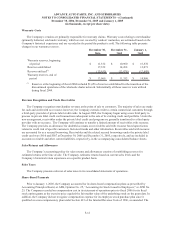

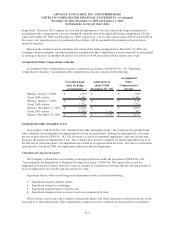

2005 2004

Net income, as reported 234,725$ 187,988$

Add: Total stock-based employee compensation

expense included in reported net income, net

of related tax effects 225 304

Deduct: Total stock-based employee compensation

expense determined under fair value based method

for all awards, net of related tax effects (9,622) (5,977)

Pro forma net income 225,328$ 182,315$

Net income per share:

Basic, as reported 2.17$ 1.70$

Basic, pro forma 2.08 1.64

Diluted, as reported 2.13 1.66

Diluted, pro forma 2.04 1.61

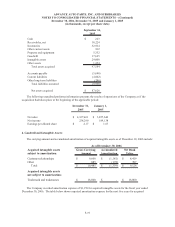

Earnings Per Share of Common Stock

Basic earnings per share of common stock has been computed based on the weighted-average number of

common shares outstanding, less stock held in treasury, during the period. Diluted earnings per share of common

stock reflects the increase in the weighted-average number of shares of common stock outstanding assuming the

exercise of outstanding stock options, calculated on the treasury stock method as modified by the adoption of SFAS

123R, and all deferred stock units outstanding during the respective period. There were 2,140, 517 and 510

antidilutive options for the fiscal years ended December 30, 2006, December 31, 2005 and January 1, 2005,

respectively.

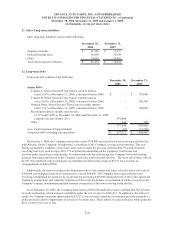

Hedge Activities

The Company utilizes interest rate swaps to limit its cash flow risk on its variable rate debt. In connection with

the refinancing of its credit facility in October 2006, the Company entered into four new interest rate swap

agreements on an aggregate of $225,000 of debt under its revolving credit facility. The Company settled its previous

three interest rate swaps, and accordingly, recognized income of $2,873 resulting from the reclassification of the

previously unrealized gain from other comprehensive income. As of December 30, 2006, the detail for the new

individual swaps is as follows:

xThe first swap fixed the Company’s LIBOR rate at 4.9675% on $75,000 of debt for a term of 60 months,

expiring in October 2011.

xThe second swap fixed the Company’s LIBOR rate at 4.9680% on $50,000 of debt for a term of 60 months,

expiring in October 2011.

xThe third swap fixed the Company’s LIBOR rate at 4.9800% on $50,000 of debt for a term of 60 months,

expiring in October 2011.

xThe fourth swap fixed the Company’s LIBOR rate at 4.9650% on $50,000 of debt for a term of 60 months,

expiring in October 2011.

In accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” the fair

value of the Company’s outstanding hedges is recorded as an asset or liability in the accompanying consolidated

balance sheets at December 30, 2006 and December 31, 2005, respectively. The Company uses the “matched terms”

accounting method as provided by Derivative Implementation Group Issue No. G9, “Assuming No Ineffectiveness

When Critical Terms of the Hedging Instrument and the Hedge Transaction Match in a Cash Flow Hedge” for the

interest rate swaps. Accordingly, the Company has matched the critical terms of each hedge instrument to the

F-14