Advance Auto Parts 2006 Annual Report Download - page 74

Download and view the complete annual report

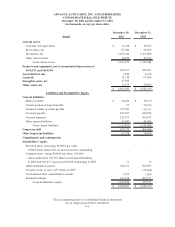

Please find page 74 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

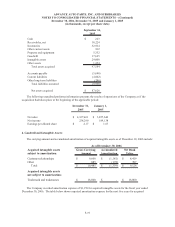

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

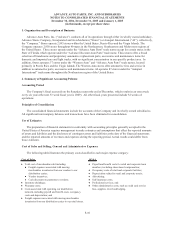

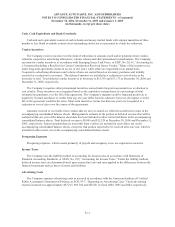

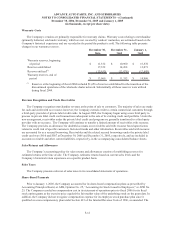

Cash, Cash Equivalents and Bank Overdrafts

Cash and cash equivalents consist of cash in banks and money market funds with original maturities of three

months or less. Bank overdrafts consist of net outstanding checks not yet presented to a bank for settlement.

Vendor Incentives

The Company receives incentives in the form of reductions to amounts owed and/or payments from vendors

related to cooperative advertising allowances, volume rebates and other promotional considerations. The Company

accounts for vendor incentives in accordance with Emerging Issues Task Force, or EITF, No. 02-16, “Accounting by

a Customer (Including a Reseller) for Certain Consideration Received from a Vendor.” Many of the incentives are

under long-term agreements (terms in excess of one year), while others are negotiated on an annual basis.

Cooperative advertising allowances and volume rebates are earned based on inventory purchases and initially

recorded as a reduction to inventory. The deferred amounts are included as a reduction to cost of sales as the

inventory is sold. Total deferred vendor incentives in inventory is $35,393 and $33,175 at December 30, 2006 and

December 31, 2005, respectively.

The Company recognizes other promotional incentives earned under long-term agreements as a reduction to

cost of sales. These incentives are recognized based on the cumulative net purchases as a percentage of total

estimated net purchases over the life of the agreement. The Company's margins could be impacted positively or

negatively if actual purchases or results from any one year differ from its estimates; however, the impact over the

life of the agreement would be the same. Short-term incentives (terms less than one year) are recognized as a

reduction to cost of sales over the course of the agreements.

Amounts received or receivable from vendors that are not yet earned are reflected as deferred revenue in the

accompanying consolidated balance sheets. Management's estimate of the portion of deferred revenue that will be

realized within one year of the balance sheet date has been included in other current liabilities in the accompanying

consolidated balance sheets. Total deferred revenue is $8,006 and $12,529 at December 30, 2006 and December 31,

2005, respectively. Earned amounts that are receivable from vendors are included in receivables, net on the

accompanying consolidated balance sheets, except for that portion expected to be received after one year, which is

included in other assets, net on the accompanying consolidated balance sheets.

Preopening Expenses

Preopening expenses, which consist primarily of payroll and occupancy costs, are expensed as incurred.

Income Taxes

The Company uses the liability method of accounting for income taxes in accordance with Statement of

Financial Accounting Standards, or SFAS, No. 109, “Accounting for Income Taxes.” Under the liability method,

deferred income taxes are determined based upon enacted tax laws and rates applied to the differences between the

financial statements and tax bases of assets and liabilities.

Advertising Costs

The Company expenses advertising costs as incurred in accordance with the American Institute of Certified

Public Accountant’s Statement of Position, or SOP, 93-7, “Reporting on Advertising Costs.” Gross advertising

expense incurred was approximately $97,215, $95,702 and $86,821 in fiscal 2006, 2005 and 2004, respectively.

F-11