Advance Auto Parts 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tax Reserves

The determination of our income tax liabilities is based upon the tax code, regulations and pronouncements of

the taxing jurisdictions in which we do business. Our income tax returns are periodically examined by those

jurisdictions. These examinations include, among other things, auditing our filing positions, the timing of

deductions and allocation of income among the various jurisdictions. At any particular time, multiple years are

subject to examination by various taxing authorities.

In evaluating our income tax positions, we record reserves for potential exposures. These contingency reserves

are adjusted in the period actual developments give rise to such change. Those developments could be, but are not

limited to; settlement of tax audits, expiration of the statute of limitations, and the evolution of tax code and

regulations, along with varying application of tax policy and administration within those jurisdictions.

These contingency reserves contain uncertainties because management is required to make assumptions and

apply judgment to estimate exposures associated with our various filing positions. Although management believes

that the judgments and estimates are reasonable, actual results could differ and the company may be exposed to

gains or losses that could be material. To the extent that actual results differ from our estimates, the effective tax

rate in any particular period could be materially affected. Favorable tax developments would be recognized as a

reduction in our effective tax rate in the period of resolution. Unfavorable tax developments would require an

increase in our effective tax rate and a possible use of cash in the period of resolution.

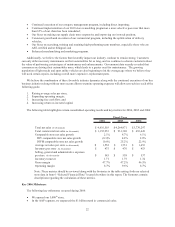

Share-Based Payments

We have a share-based compensation plan, which includes fixed stock options and deferred stock units, or

DSUs. We account for our share-based compensation plans as prescribed by the fair value provisions of SFAS No.

123R. We determine the fair value of our stock options at the date of the grant using the Black-Scholes option-

pricing model. The DSUs are awarded at a price equal to the market price of our underlying stock on the date of the

grant. The option-pricing model and generally accepted valuation techniques require management to make

assumptions and to apply judgment to determine the fair value of our awards. These assumptions and judgments

include the expected life of stock options, expected stock price volatility, future employee stock option exercise

behaviors and the estimate of stock option forfeitures. We do not believe there is a reasonable likelihood there will

be a material change in the future estimates or assumptions we use to determine stock-based compensation expense.

However, if actual results are different from these assumptions, the share-based compensation expense reported in

our financial statements may not be representative of the actual economic cost of the share-based compensation. In

addition, significant changes in these assumptions could materially impact our share-based compensation expense

on future awards. A 10% change in our share-based compensation expense for the fiscal year ended December 30,

2006 would have affected net income by approximately $1.2 million for the fiscal year ended December 30, 2006.

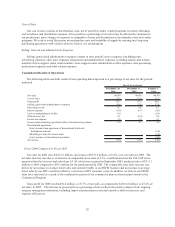

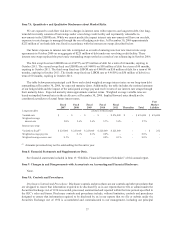

Components of Statement of Operations

Net Sales

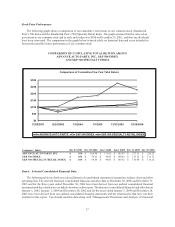

Net sales consist primarily of comparable store sales and new store net sales. We calculate comparable store

sales based on the change in net sales starting once a store has been opened for 13 complete accounting periods. We

include relocations in comparable store sales from the original date of opening. We exclude net sales from the 37

Western Auto retail stores from our comparable store sales as a result of their unique product offerings. We also

exclude the net sales from the AI stores from our comparable store sales.

Our fiscal year ends on the Saturday closest to December 31 and consists of 52 or 53 weeks. Our 2004 fiscal

year began on January 4, 2004 and consisted of 52 weeks, while our 2003 fiscal year began on December 29, 2002

and consisted of 53 weeks. The extra week of operations in fiscal 2003 resulted in our fiscal 2004 consisting of non-

comparable calendar weeks to fiscal 2003. To create a meaningful comparable store sales measure for fiscal 2004,

we have compared the calendar weeks of 2004 to the corresponding calendar weeks of fiscal 2003. Accordingly, our

calculation of comparable stores sales for fiscal 2004 excludes week one of operations from fiscal 2003.

27