Advance Auto Parts 2006 Annual Report Download - page 103

Download and view the complete annual report

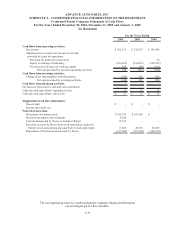

Please find page 103 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC.

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to Condensed Parent Company Statements

December 30, 2006 and December 31, 2005

(in thousands, except per share data)

See Notes to Consolidated Financial Statements for Additional Disclosures.

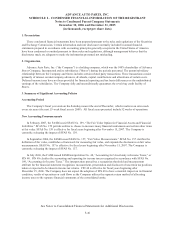

1. Presentation

These condensed financial statements have been prepared pursuant to the rules and regulations of the Securities

and Exchange Commission. Certain information and note disclosures normally included in annual financial

statements prepared in accordance with accounting principles generally accepted in the United States of America

have been condensed or omitted pursuant to those rules and regulations, although management believes that the

disclosures made are adequate to make the information presented not misleading.

2. Organization

Advance Auto Parts, Inc. (“the Company”) is a holding company, which was the 100% shareholder of Advance

Stores Company, Incorporated and its subsidiaries ("Stores") during the periods presented. The parent/subsidiary

relationship between the Company and Stores includes certain related party transactions. These transactions consist

primarily of interest on intercompany advances, dividends, capital contributions and allocations of certain costs.

Deferred income taxes have not been provided for financial reporting and tax basis differences on the undistributed

earnings of the subsidiaries. The Company fully and unconditionally guarantees the revolving credit facility of

Stores.

3. Summary of Significant Accounting Policies

Accounting Period

The Company's fiscal year ends on the Saturday nearest the end of December, which results in an extra week

every six years (the next 53 week fiscal year is 2009). All fiscal years presented include 52 weeks of operations.

New Accounting Pronouncements

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items

at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is

currently evaluating the impact of SFAS No. 159.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” SFAS No. 157 clarifies the

definition of fair value, establishes a framework for measuring fair value, and expands the disclosures on fair value

measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is

currently evaluating the impact of SFAS No. 157.

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes,” or

FIN 48. FIN 48 clarifies the accounting and reporting for income taxes recognized in accordance with SFAS No.

109, “Accounting for Income Taxes.” The interpretation prescribes a recognition threshold and measurement

attribute for the financial statement recognition, measurement, presentation and disclosure of uncertain tax positions

taken or expected to be taken in income tax returns. FIN 48 is effective for fiscal years beginning after

December 15, 2006. The Company does not expect the adoption of FIN 48 to have a material impact on its financial

condition, results of operations or cash flows as the Company utilizes the separate return method of allocating

income taxes to the separate financial statements of the consolidated entity.

F-40