Advance Auto Parts 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

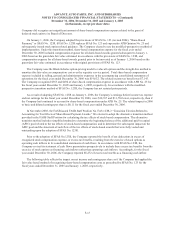

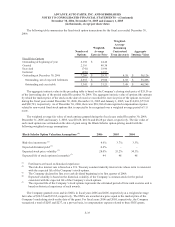

Depreciation of building and leasehold improvements is provided over the shorter of the original useful lives of the

respective assets or the term of the lease using the straight-line method. The term of the lease is generally the initial

term of the lease unless external economic factors exist such that renewals are reasonably assured in which case, the

renewal period would be included in the lease term for purposes of establishing an amortization period. Depreciation

expense was $138,064, $119,938 and $104,877 for the fiscal years ended 2006, 2005 and 2004, respectively.

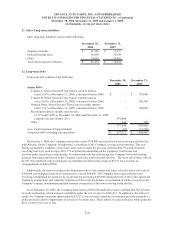

Property and equipment consists of the following:

O

r

i

g

i

nal

Useful Lives

December

30

,

2006

December

31

,

2005

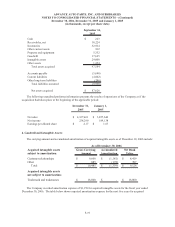

Land and land improvements 0 - 10 years 238,186$ 212,110$

Buildings 40 years 328,997 295,699

Building and leasehold improvements 10 - 40 years 197,657 159,568

Furniture, fixtures and equipment 3 - 12 years 843,645 745,142

Vehicles 2 - 10 years 24,682 35,339

Construction in progress 28,151 11,035

Other 4,230 4,516

1,665,548 1,463,409

Less - Accumulated depreciation and amortization (670,571) (564,558)

Property and equipment, net 994,977$ 898,851$

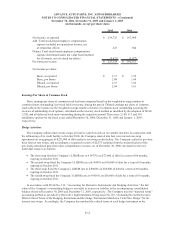

The Company capitalized approximately $3,641, $6,584 and $4,625 incurred for the development of internal

use computer software in accordance with the American Institute of Certified Public Accountant’s Statement of

Position 98-1, “Accounting for the Cost of Computer Software Developed or Obtained for Internal Use” during

fiscal 2006, fiscal 2005 and fiscal 2004, respectively. These costs are included in the furniture, fixtures and

equipment category above and are depreciated on the straight-line method over three to seven years.

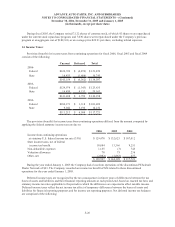

10. Accrued Expenses:

Accrued expenses consist of the following:

December 30, December 31,

2006 2005

Payroll and related benefits 48,477$ 58,553$

Warrant

y

13,069 11,352

Capital expenditures 24,011 39,105

Self-insurance reserves 58,755 39,840

Property taxes 23,427 20,029

Other 85,236 96,558

Total accrued expenses 252,975$ 265,437$

F-23