Advance Auto Parts 2006 Annual Report Download - page 54

Download and view the complete annual report

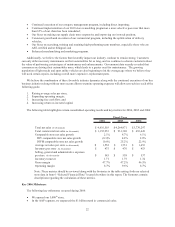

Please find page 54 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.leased, require capital expenditures of approximately $0.2 million per store. Our remodeled stores generally require

capital expenditures of approximately $0.1 million per store, which reflects a forty percent reduction from 2006

levels. We believe that we can spend less in certain areas of our remodel program while continuing to benefit from

an increase in sales from the remodeled stores. In 2007, we anticipate that our capital expenditures will be

approximately $250.0 million to $270.0 million, inclusive of approximately $30.0 million for the construction of our

new Midwest distribution center scheduled to open in mid-2008.

Additionally, our new AAP stores require an inventory investment of approximately $0.2 million per store, net

of vendor payables. A portion of the inventory investment is held at a distribution facility. Pre-opening expenses,

consisting primarily of store set-up costs and training of new store team members, average approximately $0.02

million per store and are expensed when incurred.

Vendor Financing Program

Historically, we have negotiated extended payment terms from suppliers that help finance inventory growth,

and we believe that we will be able to continue financing much of our inventory growth through such extended

payment terms. In fiscal 2004, we entered into a short-term financing program with a bank for certain merchandise

purchases. In substance, the program allows us to borrow money from the bank to finance purchases from our

vendors. This program allows us to reduce further our working capital invested in current inventory levels and

finance future inventory growth. Our new revolving credit facility does not restrict availability under this program.

At December 30, 2006, $127.5 million was payable to the bank by us under this program.

Stock Repurchase Program

During the third quarter of fiscal 2005, our Board of Directors authorized a program to repurchase up to $300

million of our common stock plus related expenses. The program replaced the remaining portion of a previous

repurchase program. The program allows us to repurchase our common stock in the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the Securities and Exchange

Commission. As of December 30, 2006, we had repurchased a total of 5.2 million shares of common stock under

the program, at an aggregate cost of $196.0 million, or an average price of $37.63 per share, excluding related

expenses. At December 30, 2006, we had $104.0 million, excluding related expenses, available for future stock

repurchases under the stock repurchase program.

During fiscal 2006, we retired 5.1 million shares of common stock which were previously repurchased under

the $300 million stock repurchase program.

During fiscal 2005, we retired 7.1 million shares of common stock, of which 0.1 million shares were

repurchased under the current stock repurchase plan, and 7.0 million shares were repurchased under our previous

program at an aggregate cost of $189.2 million, or an average price of $26.91 per share, excluding related expenses.

Deferred Compensation and Postretirement Plans

We maintain a non-qualified deferred compensation plan established for certain of our key team members. This

plan provides for a minimum and maximum deferral percentage of the team member base salary and bonus, as

determined by our Retirement Plan Committee. We fund the plan liability by remitting the team members’ deferrals

to a Rabbi Trust where these deferrals are invested in certain life insurance contracts. Accordingly, the cash

surrender value on these contracts is held in the Rabbi Trust to fund the deferred compensation liability. At

December 30, 2006, the liability related to this plan was $3.4 million, all of which is current.

We provide certain health care and life insurance benefits for eligible retired team members through our

postretirement plan. At December 30, 2006, our accrued benefit cost related to this plan was $10.5 million. The

plan has no assets and is funded on a cash basis as benefits are paid/incurred. The discount rate that we utilize for

determining our postretirement benefit obligation is actuarially determined. The discount rate utilized at December

30, 2006 and December 31, 2005 was 5.5% and 5.5%, respectively. We reserve the right to change or terminate the

benefits or contributions at any time. We also continue to evaluate ways in which we can better manage these

31