Advance Auto Parts 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, we are subject to numerous federal, state and local laws and governmental regulations relating to

employment matters, environmental protection and building and zoning requirements. If we fail to comply with

existing or future laws or regulations, we may be subject to governmental or judicial fines or sanctions. In addition,

our capital expenses could increase due to remediation measures that may be required if we are found to be

noncompliant with any existing or future laws or regulations.

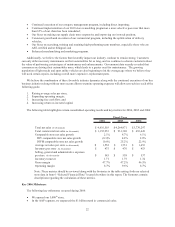

Risks Relating to Our Financial Condition

The covenants governing our revolving credit facility impose restrictions on us.

The terms of our revolving credit facility impose operating and financial restrictions on us and our subsidiaries

and require us to meet certain financial tests. These restrictions may also have a negative impact on our business,

financial condition and results of operations by significantly limiting or prohibiting us from engaging in certain

transactions, including:

xincurring or guaranteeing additional indebtedness;

xmaking capital expenditures and other investments;

xincurring liens on our assets and engaging in sale-leaseback transactions;

xissuing or selling capital stock of our subsidiaries;

xtransferring or selling assets currently held by us;

xengaging in transactions with affiliates;

xentering into any agreements that restrict dividends from our subsidiaries; and

xengaging in mergers or acquisitions.

The failure to comply with any of these covenants would cause a default under our revolving credit facility.

Furthermore, our revolving credit facility contains certain financial covenants, including a maximum leverage ratio

and a minimum coverage ratio, which, if not maintained by us, will cause us to be in default under our revolving

credit facility. Any of these defaults, if not waived, could result in the acceleration of all of our debt, in which case

the debt would become immediately due and payable. If this occurs, we may not be able to repay our debt or borrow

sufficient funds to refinance it. Even if new financing were available, it may be on terms that are less favorable or

otherwise not acceptable to us.

Item 1B. Unresolved Staff Comments.

None.

13