Advance Auto Parts 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

The interest rates on borrowings under the new revolving credit facility will be based, at the Company’s option,

on an adjusted LIBOR rate, plus a margin, or an alternate base rate, plus a margin. After an initial interest period, the

Company may elect to convert a particular borrowing to a different type. The initial margin is 0.75% and 0.0% per

annum for the adjusted LIBOR and alternate base rate borrowings, respectively. A commitment fee will be charged

on the unused portion of the revolver, payable in arrears. The initial commitment fee rate is 0.150% per annum.

Under the terms of the new revolving credit facility, the interest rate spread and commitment fee will be based on

the Company’s credit rating. The revolving credit facility terminates on October 5, 2011.

The new revolving credit facility is fully and unconditionally guaranteed by Advance Auto Parts, Inc. The

facility contains covenants restricting the ability of the Company and its subsidiaries to, among other things, (1)

create, incur or assume additional debt (including hedging arrangements), (2) incur liens or engage in sale-leaseback

transactions, (3) make loans and investments, (4) guarantee obligations, (5) engage in certain mergers, acquisitions

and asset sales, (6) engage in transactions with affiliates, (7) change the nature of the Company’s business and the

business conducted by its subsidiaries and (8) change the holding company status of the Company. The Company is

required to comply with financial covenants with respect to a maximum leverage ratio and a minimum coverage

ratio. The new revolving credit facility also provides for customary events of default, including non-payment

defaults, covenant defaults and cross-defaults to the Company’s other material indebtedness.

In fiscal 2004, the Company wrote-off existing deferred financing costs as a result of refinancing its outstanding

term loans. The write-off of these costs combined with the related refinancing costs incurred to set up the credit

facility resulted in a loss on extinguishment of debt of $2,818 in the accompanying consolidated statements of

operations for the year ended January 1, 2005. During fiscal 2004, prior to the refinancing of its credit facility, the

Company repaid $105,000 in debt prior to its scheduled maturity. In conjunction with these partial repayments, the

Company wrote-off deferred financing costs in the amount of $412, which is classified as a loss on extinguishment

of debt in the accompanying consolidated statement of operations for the year ended January 1, 2005.

The Company was in compliance with the above covenants under the revolving credit facility at December 30,

2006.

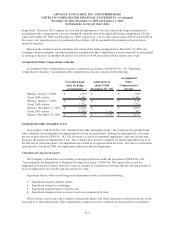

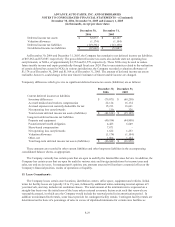

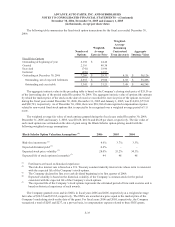

At December 30, 2006, the aggregate future annual maturities of long-term debt are as follows:

2007 67$

2008 75

2009 71

2010 73

2011 476,869

Thereafter 85

477,240$

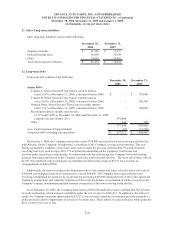

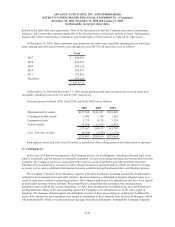

13. Stock Repurchase Program:

During fiscal 2005, the Company’s Board of Directors authorized a program to repurchase up to $300,000 of

the Company’s common stock plus related expenses. The program, which became effective August 15, 2005,

replaced the remaining portion of a previous stock repurchase program. The program allows the Company to

repurchase its common stock on the open market or in privately negotiated transactions from time to time in

accordance with the requirements of the Securities and Exchange Commission. As of December 30, 2006, the

Company had repurchased a total of 5,209 shares of common stock under the program, at an aggregate cost of

$196,013, or an average price of $37.63 per share, excluding related expenses. At December 30, 2006, the Company

had $103,987, excluding related expenses, available for future stock repurchases under the stock repurchase

program.

During fiscal 2006, the Company retired 5,117 shares of common stock which were previously repurchased

under the Company’s current stock repurchase program.

F-25