Advance Auto Parts 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

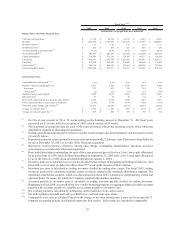

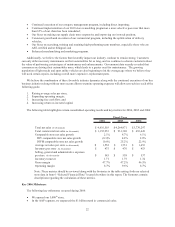

2006 2005 2004 2003 2002

Balance Sheet and Other Financial Data:

Cash and cash equivalents 11,128$ 40,783$ 56,321$ 11,487$ 13,885$

Inventory 1,463,340$ 1,367,099$ 1,201,450$ 1,113,781$ 1,048,803$

Inventory turnover

(7)

1.71 1.75 1.74 1.72 1.75

Inventory per store

(8)

475$ 476$ 453$ 439$ 429$

Accounts payable to inventory ratio

(9)

53.2% 54.8% 53.7% 51.0% 44.9%

Net working capital

(10)

498,553$ 406,476$ 416,302$ 372,509$ 462,896$

Capital expenditures 258,586$ 216,214$ 179,766$ 101,177$ 98,186$

Total assets 2,682,681$ 2,542,149$ 2,201,962$ 1,983,071$ 1,965,225$

Total debt 477,240$ 438,800$ 470,000$ 445,000$ 735,522$

Total net debt

(11)

500,318$ 448,187$ 433,863$ 464,598$ 722,506$

Total stockholders' equity 1,030,854$ 919,771$ 722,315$ 631,244$ 468,356$

Selected Store Data:

Comparable store sales growth

(12)

2.1% 8.7% 6.1% 3.1% 5.5%

Number of stores at beginning of year 2,872 2,652 2,539 2,435 2,484

New stores 215 231 125 125 110

Closed stores

(13)

(5) (11) (12) (21) (159)

Number of stores, end of period 3,082 2,872 2,652 2,539 2,435

Relocated stores 47 54 34 32 39

Stores with commercial delivery program, end of period 2,526 2,254 1,945 1,625 1,411

Total commercial sales, as a percentage of total sales 25.0% 21.8% 18.4% 15.8% 15.0%

Total store square footage, end of period

(14)

22,235 20,899 19,734 18,875 18,108

Average net sales per store

(15)

1,552$ 1,551$ 1,453$ 1,379$ 1,303$

Average net sales per square foot

(16)

209$ 208$ 195$ 186$ 174$

Fiscal Year

(1)(2)

(in thousands, except per share data and ratios)

(1) Our fiscal year consists of 52 or 53 weeks ending on the Saturday nearest to December 31. All fiscal years

presented are 52 weeks, with the exception of 2003, which consists of 53 weeks.

(2) The statement of operations data for each of the years presented reflects the operating results of the wholesale

distribution segment as discontinued operations.

(3) Selling, general and administrative expenses exclude certain charges disclosed separately and discussed in notes

(4) and (5) below.

(4) Represents expenses related primarily to lease costs associated with 27 Advance Auto Parts stores identified to be

closed at December 29, 2001 as a result of the Discount acquisition.

(5) Represents certain expenses related to, among other things, overlapping administrative functions and store

conversions as a result of the Discount acquisition.

(6) Basic and diluted shares outstanding for each of the years presented gives effect to a 3-for-2 stock split effectuated

by us in the form of a 50% stock dividend distributed on September 23, 2005 and a 2-for-1 stock split effectuated

by us in the form of a 100% stock dividend distributed on January 2, 2004.

(7) Inventory turnover is calculated as cost of sales divided by the average of beginning and ending inventories. The

fiscal 2003 cost of sales excludes the effect of the 53rd week in the amount of $34.3 million.

(8) Inventory per store is calculated as ending inventory divided by ending store count. For fiscal 2003, ending

inventory used in this calculation excludes certain inventory related to the wholesale distribution segment. The

wholesales distribution segment, which was discontinued in fiscal 2003, consisted of independently owned and

operated dealer locations, for which the Company supplied merchandise inventory.

(9) Accounts payable to inventory ratio is calculated as ending accounts payable divided by ending inventory.

Beginning in fiscal 2004, as a result of our new vendor financing program, we aggregate financed vendor accounts

payable with accounts payable to calculate our accounts payable to inventory ratio.

(10) Net working capital is calculated by subtracting current liabilities from current assets.

(11) Net debt includes total debt and bank overdrafts, less cash and cash equivalents.

(12) Comparable store sales is calculated based on the change in net sales starting once a store has been open for 13

complete accounting periods (each period represents four weeks). Relocations are included in comparable

19