Advance Auto Parts 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.damaged capital assets at replacement value. Accordingly, earnings for fiscal 2006 reflected $1.4 million of

insurance recoveries, net of deductibles.

Critical Accounting Policies

Our financial statements have been prepared in accordance with accounting policies generally accepted in the

United States of America. Our discussion and analysis of the financial condition and results of operations are based

on these financial statements. The preparation of these financial statements requires the application of accounting

policies in addition to certain estimates and judgments by our management. Our estimates and judgments are based

on currently available information, historical results and other assumptions we believe are reasonable. Actual results

could differ from these estimates.

The preparation of our financial statements included the following significant estimates.

Vendor Incentives

We receive incentives from vendors as a result of purchasing and promoting their products through a variety of

programs, including cooperative advertising allowances, volume rebates and other promotional incentives. We

account for vendor incentives in accordance with Emerging Issues Task Force, or EITF, No. 02-16, “Accounting by

a Customer (Including a Reseller) for Certain Consideration Received from a Vendor.” Many of the incentives are

under long-term agreements (terms in excess of one year), while others are negotiated on an annual basis.

Cooperative advertising allowances and volume rebates are earned based on inventory purchases and initially

recorded as a reduction to inventory. The deferred amounts are included as a reduction to cost of sales as the

inventory is sold.

We recognize other promotional incentives earned under long-term agreements as a reduction to cost of sales.

These incentives are recognized based on the cumulative net purchases as a percentage of total estimated net

purchases over the life of the agreement. Our margins could be impacted positively or negatively if actual purchases

or results from any one year differ from our estimates; however, the impact over the life of the agreement would be

the same. Short-term incentives (terms less than one year) are recognized as a reduction to cost of sales over the

course of the agreements.

Amounts received or receivable from vendors that are not yet earned are reflected as deferred revenue.

Management's estimate of the portion of deferred revenue that will be realized within one year of the balance sheet

date is included in other current liabilities. Earned amounts that are receivable from vendors are included in

receivables except for that portion expected to be received after one year, which is included in other assets.

Inventory Reserves

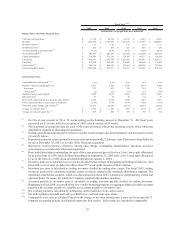

We establish reserves for inventory shrink, as an increase to our cost of sales, for our stores and distribution

centers based on our extensive and frequent cycle counting program. Our estimates of these shrink reserves depend

on the accuracy of the program, which is dependent on compliance rates of our facilities and the execution of the

required procedures. We evaluate the accuracy of this program on an ongoing basis and believe it provides

reasonable assurance for the established reserves. If estimates regarding our cycle counting program are inaccurate,

we may be exposed to losses or gains that could be material.

We have recorded reserves for potentially excess and obsolete inventories based on current inventory levels and

historical analysis of product sales and current market conditions. The nature of our inventory is such that the risk

of obsolescence is minimal and excess inventory has historically been returned to our vendors for credit. We provide

reserves where less than full credit is expected from a vendor or where we anticipate that items will be sold at retail

prices that are less than recorded cost. We develop these estimates based on the determination of return privileges

with vendors, the level of credit provided by the vendor and management’s estimate of the discounts to recorded

cost, if any, required by market conditions. Future changes by vendors in their policies or willingness to accept

returns of excess inventory could require us to revise our estimates of required reserves for excess and obsolete

inventory and result in a negative impact on our consolidated statement of operations. A 10% difference in actual

inventory reserves at December 30, 2006 would have affected net income by approximately $1.9 million.

25