Advance Auto Parts 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

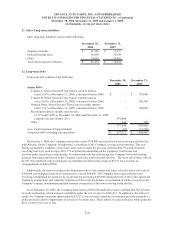

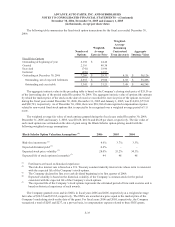

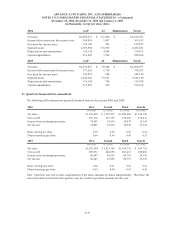

The Company expects plan contributions to completely offset benefits paid. The following table summarizes the

Company's expected benefit payments (net of retiree contributions) to be paid for each of the following fiscal years:

Amount

2007 1,048$

2008 1,100

2009 1,155

2010 1,138

2011 1,140

2012-2016 4,893

The Company reserves the right to change or terminate the benefits or contributions at any time. The Company

also continues to evaluate ways in which it can better manage these benefits and control costs. Any changes in the

plan or revisions to assumptions that affect the amount of expected future benefits may have a significant impact on

the amount of the reported obligation, annual expense and projected benefit payments.

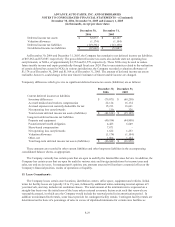

The Company adopted SFAS No. 158 on December 30, 2006. As a result, the Company recorded an actuarial

gain to accumulated other comprehensive income, net of tax, and recognized previously unamortized prior service

cost that had not yet been included in net periodic postretirement benefit cost as of December 30, 2006. The

adoption of SFAS No. 158 had no impact on net income, but increased comprehensive income by $3,316, net of tax.

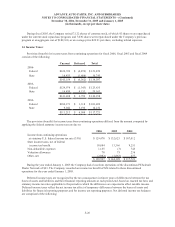

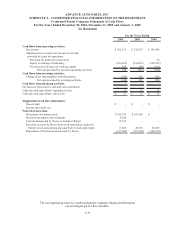

The table below shows the incremental effect of applying SFAS No. 158 on individual line items in the Company’s

consolidated balance sheet as of December 30, 2006:

Before Application

of Statement 158 Adjustments

After Application

of Statement 158

Accrued expenses 251,955$ 1,020$ 252,975$

Other long-term liabilities 65,570 (4,336) 61,234

Accumulated other comprehensive income 156 3,316 3,472

Total stockholders' equity 1,027,538 3,316 1,030,854

At December 30, 2006, the net unrealized gain on the postretirement plan consists of an unrealized gain of

$5,951 related to prior service cost and an unrealized net loss of $594 related to actuarial losses. Approximately

$581 of the unrealized gain related to prior service cost is expected to be recognized as a component of net periodic

postretirement benefit cost in fiscal 2007.

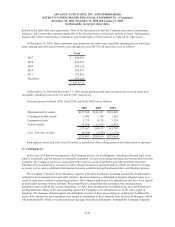

18. Share-Based Compensation Plans:

The Company has share-based compensation plans as allowed under its long-term incentive plan, or LTIP,

which includes fixed stock options and deferred stock units, or DSUs. The stock options authorized to be granted are

non-qualified stock options and terminate on the seventh anniversary of the grant date. Additionally, the stock

options vest over a three-year period in equal installments beginning on the first anniversary of the grant date and

contain no post-vesting restrictions other than normal trading black-out periods prescribed by the Company’s

corporate governance policies. The Company grants DSUs annually to its Board of Directors as provided for in the

Advance Auto Parts, Inc. Deferred Stock Unit Plan for Non-Employee Directors and Selected Executives, or the

DSU Plan. Each DSU is equivalent to one share of common stock of the Company. The DSUs are immediately

vested upon issuance but are held on behalf of the director until he or she ceases to be a director. The DSUs are then

distributed to the director following his or her last date of service. Additionally, the DSU Plan provides for the

deferral of compensation as earned in the form of an annual retainer for board members and wages for certain highly

compensated employees of the Company. These deferred stock units are settled in common stock with the

participants at a future date or over a specified time period as elected by the participants in accordance with the DSU

Plan.

F-32