Advance Auto Parts 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenses, including an examination of both corporate and store-level and (4) continuing to implement our category

management and custom mix initiatives and increase direct importing, including the expansion of our private label

and proprietary brands in our AAP stores.

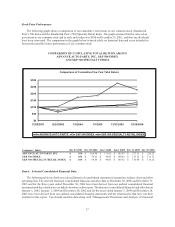

Increase Free Cash Flow. We have generated free cash flow over the last five years. Our strategy is to invest

back into our business to drive further progress towards our four financial goals. We look to deploy additional cash

in the most optimal way to increase shareholder value, which has included stock repurchases and selective

acquisitions and more recently cash dividends.

Increase Return on Invested Capital. We believe we can increase our return on invested capital by increasing

our average sales per store and our margins. We believe we can also increase our return on invested capital by

leveraging our supply chain initiatives to increase sales faster than inventory growth, implementing a lower cost

store remodel program and selectively expanding our store base primarily in existing markets. Based on our

experience, such in-market openings provide higher returns on our invested capital by enabling us to leverage our

distribution infrastructure, marketing expenditures and local management resources. We intend to open 200 to 210

AAP and AI stores primarily in existing markets in 2007.

Industry

The United States automotive aftermarket industry is generally grouped into two major categories: DIY and

DIFM. According to the Automotive Aftermarket Industry Association, or AAIA, the DIY category represents an

approximate $35 billion market with sales to consumers who maintain and repair vehicles themselves. Per the

AAIA, the DIFM category represents an approximate $75 billion market with sales to professional installers, such as

independent garages, service stations and auto dealers. DIFM parts and services are typically offered to vehicle

owners who are less inclined to repair their vehicles themselves. The DIFM category includes an approximate $36

billion market which includes dealer purchases directly from the original equipment manufacturers.

We believe the United States automotive aftermarket industry will benefit from several favorable trends,

including the:

xincreasing number and age of vehicles in the United States, increasing number of miles driven annually,

and increasing number of cars coming off of warranty, particularly previously leased vehicles;

xhigher cost of replacement parts as a result of technological changes in recent models of vehicles and

increasing number of light trucks and sport utility vehicles that require more expensive parts, resulting in

higher average sales per customer;

xcontinued consolidation of automotive aftermarket retailers;

xmove to higher priced premium parts, which offer enhanced features, benefits and/or warranties; and

xmarket share growth opportunities for specialty retailers relative to other channels selling similar

merchandise.

Item 1A. Risk Factors.

Risks Relating to Our Business

We may not be able to successfully implement our business strategy, including increasing comparable store

sales, enhancing our margins and increasing our return on invested capital, which could adversely affect our

business, financial condition and results of operations.

We have implemented numerous initiatives to increase comparable store sales, enhance our margins and

increase our return on invested capital in order to increase our earnings and cash flow. If these initiatives are

unsuccessful, or if we are unable to implement the initiatives efficiently and effectively, our business, financial

condition and results of operations could be adversely affected.

Successful implementation of our business strategy also depends on factors specific to the retail automotive

parts industry and numerous other factors that may be beyond our control. Adverse changes in the following factors

10